Wise: A Disruptor in the Remittance Market

How to become the lowest-cost provider in global money transfers

Summary

The remittance market consists of three main types of participants: banks, traditional money transfer operators (MTOs), and digital fintech platforms. Banks account for approximately 40% of the market, while traditional MTOs and fintech services each hold about 30%. Fintechs are rapidly gaining share due to their ability to offer lower transaction costs compared to banks and MTOs.

Fintechs achieve greater cost efficiency through: (a) digital channels, which eliminate intermediaries at the customer interaction stage; and (b) liquidity management (local pools, netting), which minimizes the need for correspondent banks during the actual movement of funds.

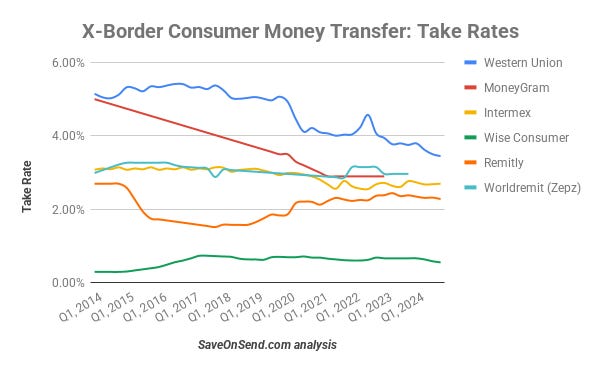

Wise (WISE.L; WPLCF) offers the lowest-cost solution in the industry: the average take rate for personal transfers is 0.57%, and for business transfers – 0.39%. The blended take rate stands at 0.52%, down from 0.64% a year earlier. For comparison, Western Union’s rate remains around ~3.5%, and Remitly’s at ~2.3%.

The low take rate is a result of Wise’s advanced infrastructure, which took years to build. Replicating it is difficult, requiring dozens of integrations, licenses, and regulatory approvals across jurisdictions. This creates a strong competitive moat, which Wise continues to deepen by deliberately lowering its take rate as it scales.

The low take rate drives higher transfer volumes and growing customer balances held in Wise’s multi-currency accounts – a key source of interest income. This creates a self-reinforcing cycle: lower fees drive volume growth, which in turn enables further price cuts, making Wise increasingly competitive.

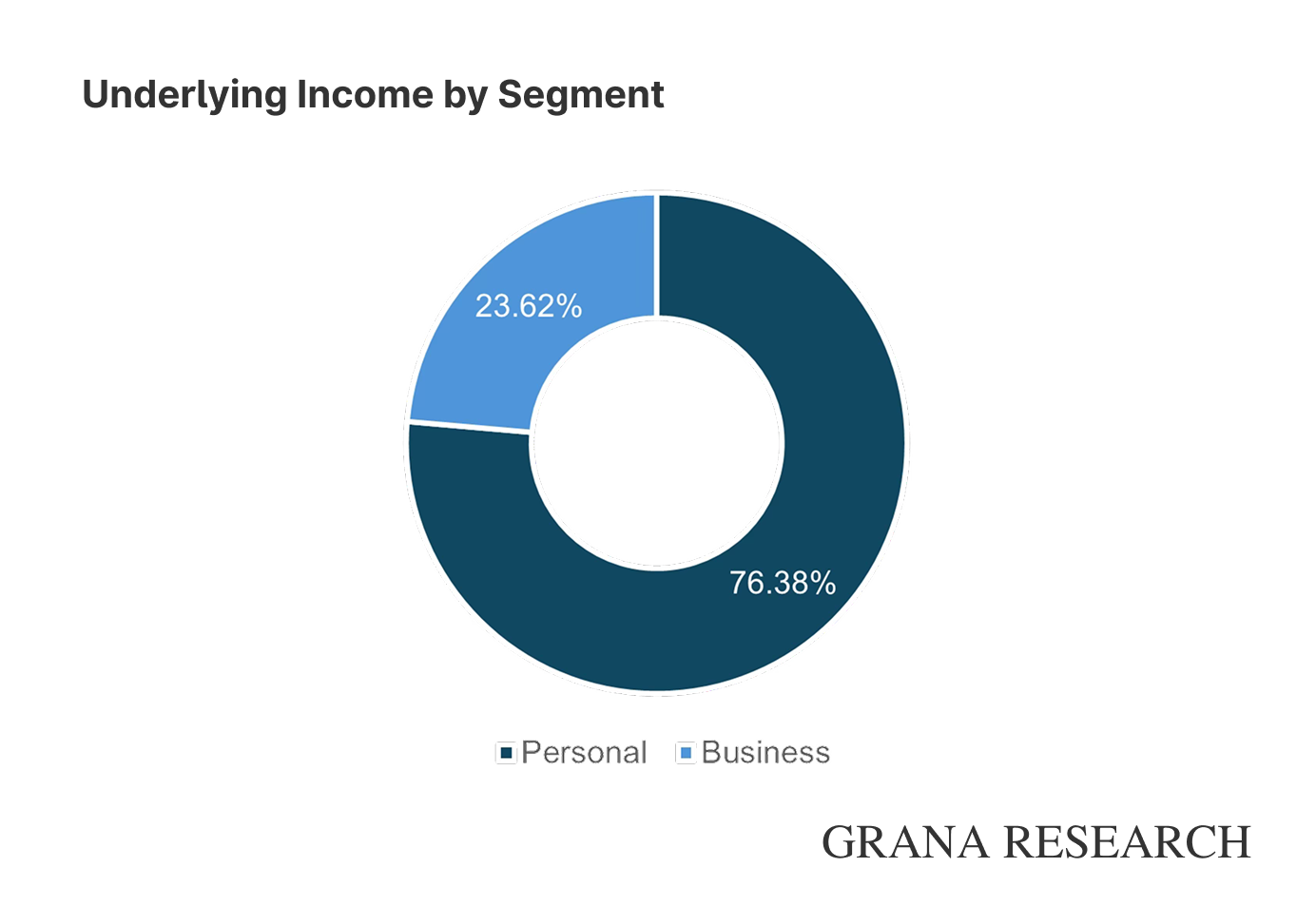

Wise has multiple growth levers. Its core business remains the B2C segment with the Wise Account, which drives growth in customer balances, card revenues, and interest income. The B2B segment (Wise Business) also holds significant potential, as the corporate remittance market is much larger and Wise’s current penetration remains low.

Wise Platform enables fintechs and banks to embed transfers into their products. While it currently accounts for less than 5% of volume, it is already used by players like Morgan Stanley, Interactive Brokers, and Raiffeisen Bank, and could become a major volume growth driver. Management expects the Platform to reach 10% of total volumes in the medium term and over 50% in the long term.

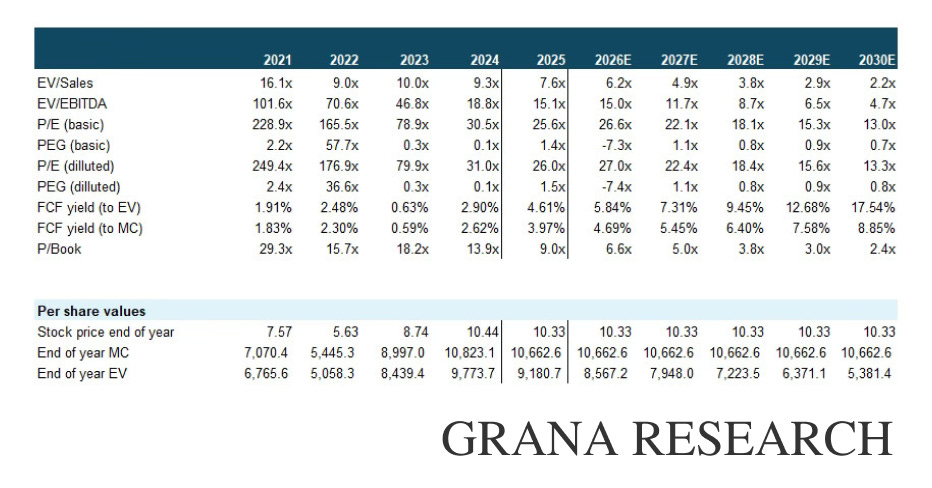

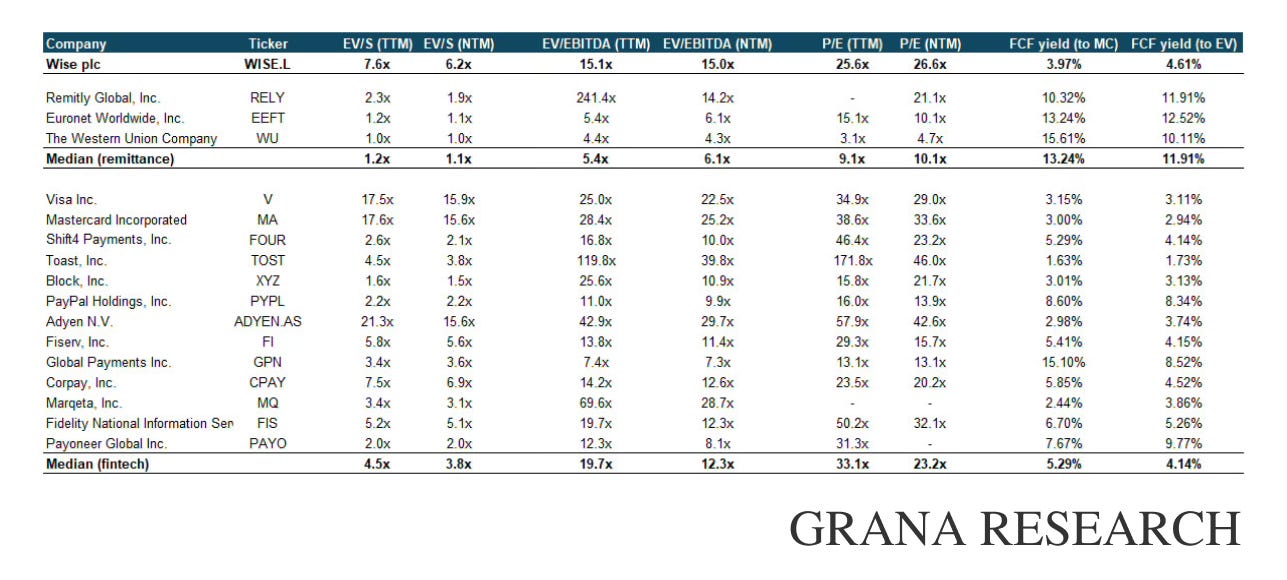

While Wise trades at a premium to most remittance peers, we believe current valuation levels are reasonable for initiating a position: the company is trading at a 2025 FCF yield (to EV) of ~4.61% and a 2026 yield of ~5.84%, with expected Free Cash Flow growth of 18.2% in 2026 and a projected FCF CAGR of ~17.2% through 2030.

We include Wise in our cohort of high-conviction ideas with a target allocation of 10% of NAV. We are initiating one-third of the position at current levels.

Our financial model for the company is available here.

The Company

The story of Wise began back in 2007, when Kristo Käärmann, a Big Four consultant living in London, and Taavet Hinrikus, then Director of Strategy at Skype, realized they shared the same problem: high currency exchange costs when sending money to and from their native Estonia. Hinrikus received his salary in Estonian kroons and converted them into British pounds each month; Käärmann did the opposite, converting his GBP salary into kroons.

The future co-founders came up with a simple solution: each month, Käärmann would top up Hinrikus’s UK account, and Hinrikus would do the same for Käärmann’s Estonian account, setting the amounts based on the mid-market exchange rate.

The idea quickly spread among other Estonian expats and evolved into a Skype chat group. In 2011, the informal money exchange forum transformed into TransferWise [1]. That same year, the company raised a $1.3 million seed round with participation from IA Ventures, Index Ventures, Max Levchin, and Peter Thiel. Since then, Wise has completed seven more funding rounds, growing from a startup into a public company with a valuation of £8.75 billion at the time of its IPO in July 2021 [2].

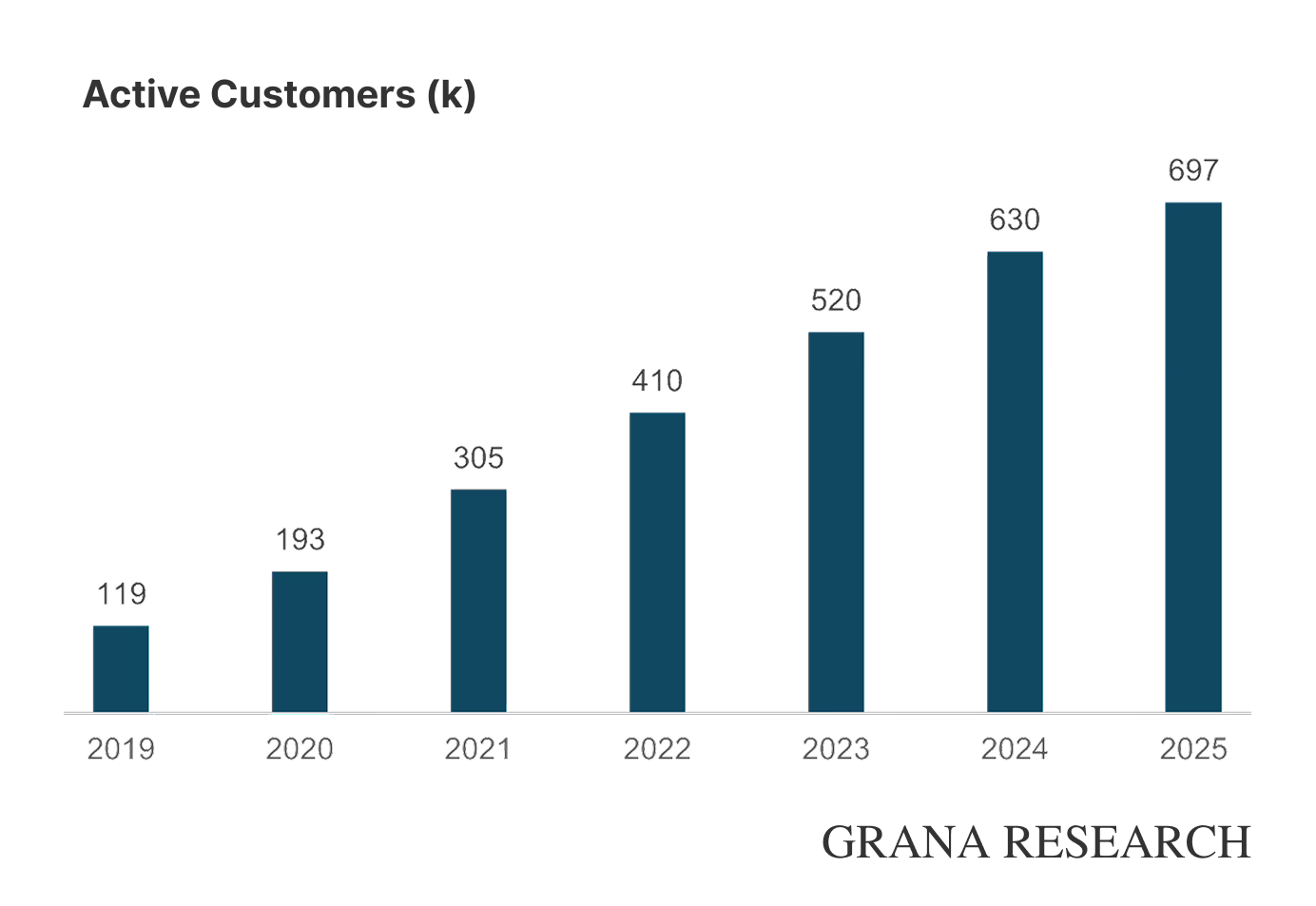

Today, Wise is one of the largest players in the industry, with a market share of less than 5% in P2P remittances and under 1% in small business transfers. Over the past four years, the company’s active customer base has grown 2.8x, cross-border payment volume by 2.9x, and revenue by 3.1x [3].

Wise remains founder-led. Kristo Käärmann is the CEO and owns 18.23% of Class A shares and 46.6% of Class B shares, giving him control of approximately 49.3% of total voting rights. Taavet Hinrikus left the company in 2021 but retained 5.4% of Class A shares and 8.4% of Class B shares, representing about 12.2% of voting power [4]. Class B shares do not grant rights to the company’s earnings but carry nine votes per share [5].

The Money Transfer Industry

The global money transfer market consists of two main segments:

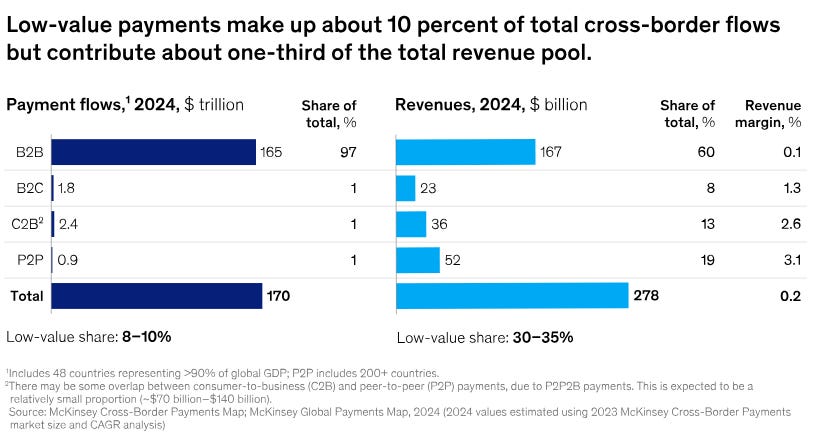

Personal transfers (P2P) — money sent between individuals. This segment is commonly referred to as remittances. While it accounts for a relatively small share of total payment volume, it generates a disproportionately high share of industry revenue due to steep fees. According to McKinsey, low-value cross-border transactions — including P2P remittances, small P2B, B2C, and SME B2B payments — represent only about 10% of global payment volume, which is estimated at $162 trillion in 2024 [6]. Yet, these small transactions are thought to generate up to one-third of total market revenue, thanks to a high average take rate of around 6.6% [7]. Wise estimates the annual remittance volume at $2 trillion [3].

Corporate transfers — cross-border payments between companies, financial institutions, trade settlements, and more. This segment dominates by volume, accounting for 90%+ of global flows by value. B2B payments by large corporations and banks alone amounted to tens of trillions of dollars in 2024. The total volume of all cross-border business payments is estimated at $146–150 trillion annually [6]. These payments are typically processed through banks and the SWIFT correspondent network, with lower fees thanks to large transaction sizes. However, even in the corporate space, a clear divide is emerging: while large transactions remain with traditional banks, small and medium-sized enterprises (SMEs) are increasingly turning to fintech providers for smaller international payments. In fact, 35% to 50% of SMEs in North America, Europe, and emerging Asia have used non-bank fintech services for international payments at least once a year [6]. Wise estimates that small businesses transfer around $12 trillion annually, with this segment growing at a 9% CAGR over the past two years.

The US dollar and the euro are the dominant currencies in the industry, facilitating the majority of global payment flows. According to SWIFT data, USD and EUR together accounted for over 70% of all international payments in 2024 [8].

The money transfer market is made up of three main types of players: banks, traditional money transfer operators (MTOs), and fintech platforms. MTOs and fintechs combined handle approximately 60% of global transfer volumes, while banks account for the remaining 40% [9].

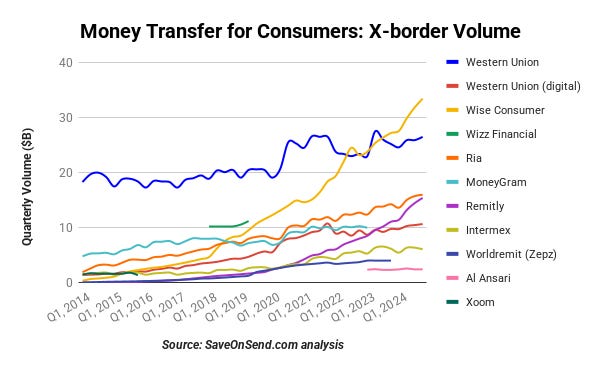

Within the non-bank segment, fintech is rapidly gaining ground. In the 2010s, the majority of non-bank transfers were processed via offline networks like Western Union and other MTOs. By the mid-2020s, however, roughly 50% of all transfers were already being made through digital channels [10]. This trend is expected to continue, with the digital remittance market projected to grow at 16–17% annually through 2030, significantly outpacing the overall market growth rate of ~5–6% [11][12].

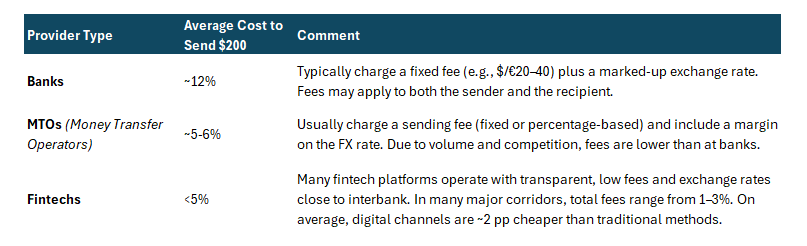

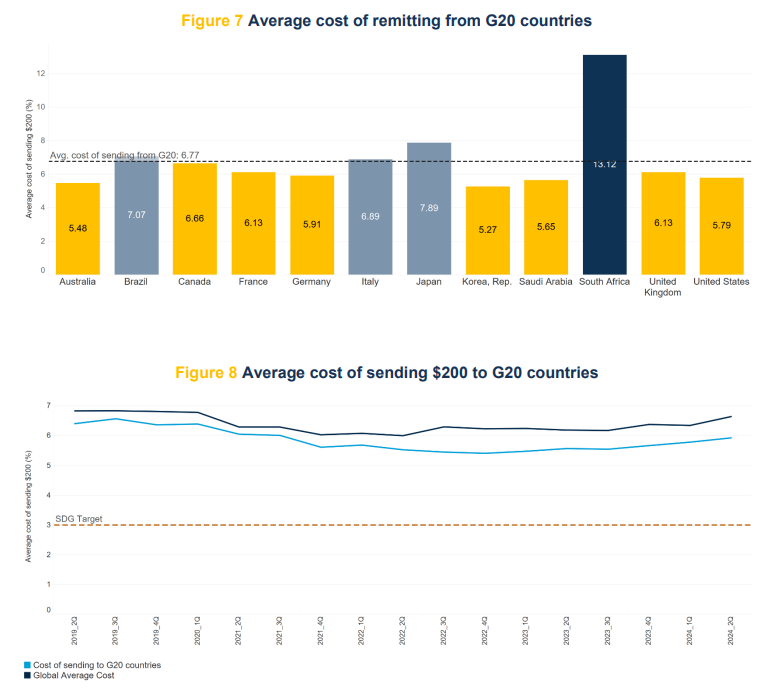

The disruptive nature of fintechs lies in their ability to offer significantly lower transaction costs compared to both banks and MTOs. For end users, the key parameters when sending money are the transfer fee and the exchange rate margin. According to the World Bank, the current average cost of sending money from G20 countries stands at 6.77% [11].

Below is a comparison of average fees for sending $200 based on provider type [7].

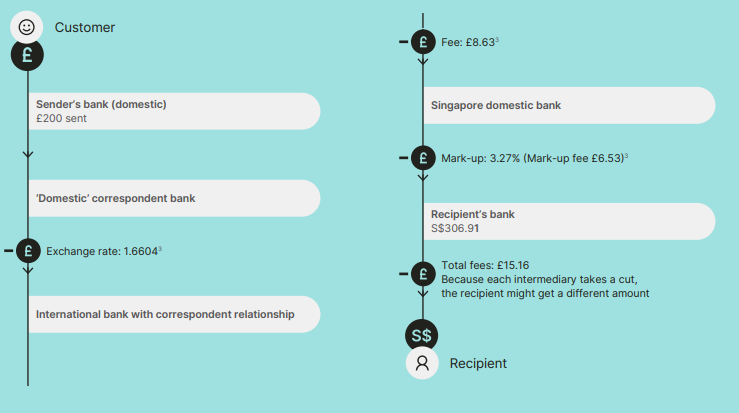

Banks are the most expensive option. Their infrastructure relies on the SWIFT interbank messaging system and a network of correspondent accounts. In a cross-border bank transfer, funds move through a chain of institutions: the sending bank sends a SWIFT message to its correspondent (or directly to the recipient bank if a direct relationship exists), and the money is routed through Nostro/Vostro accounts — accounts that banks hold with one another to settle international transactions — before finally being credited to the recipient’s account. This process is relatively complex and can take several days, especially when multiple intermediaries are involved.

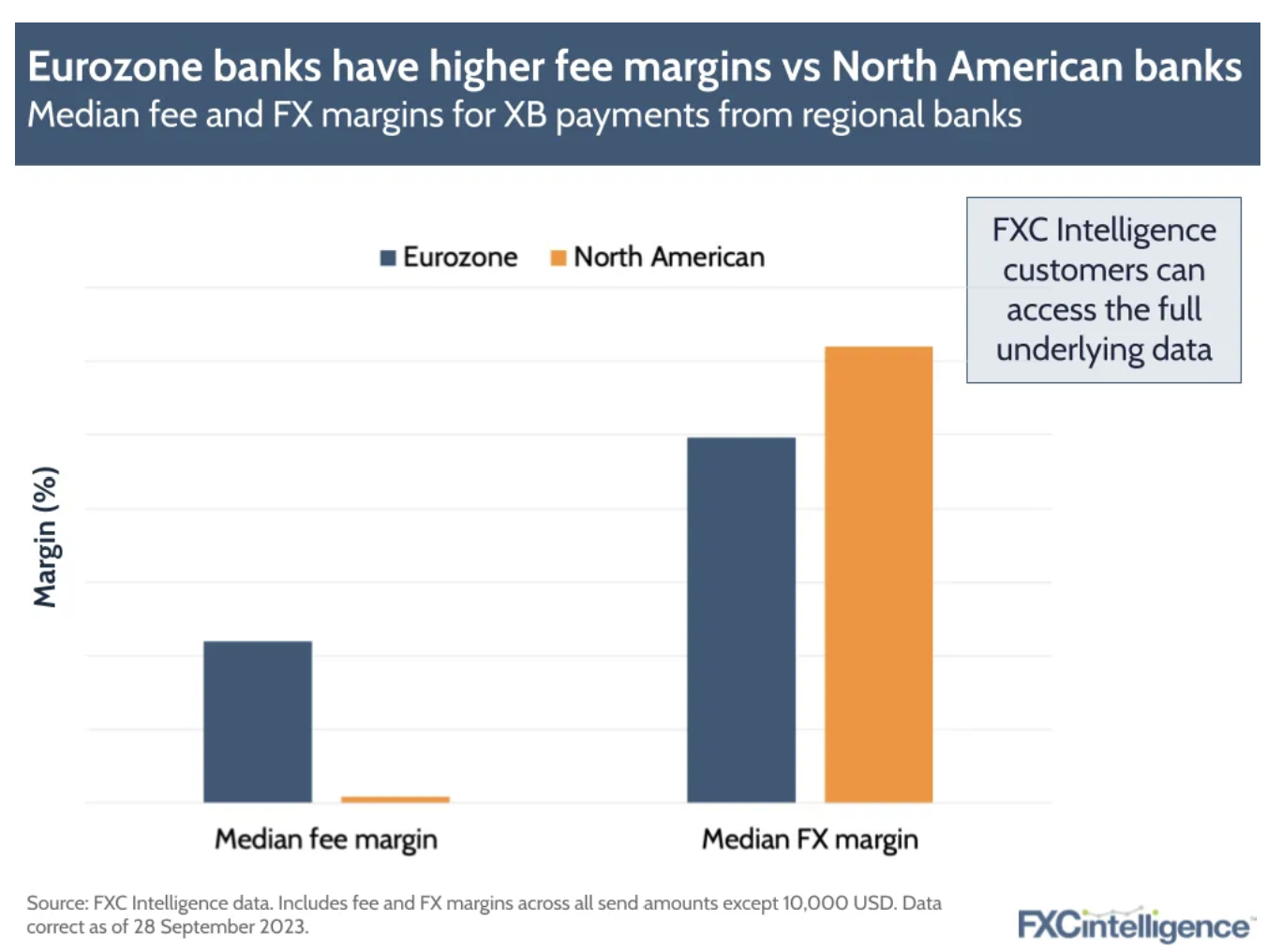

It is precisely the fact that funds pass through a chain of intermediaries — each aiming to profit from the transaction — that makes the overall cost to the customer so high. Notably, since bank transfer fees are typically fixed, banks tend to earn more from the FX spread. This makes their pricing model less transparent.

The largest players in the bank-led segment of the money transfer market are primarily those with extensive international networks of subsidiaries. These subsidiaries allow banks to use their own internal FX rates and settlement systems, bypassing SWIFT and third-party correspondent banks. They also enable banks to act as correspondents for others.

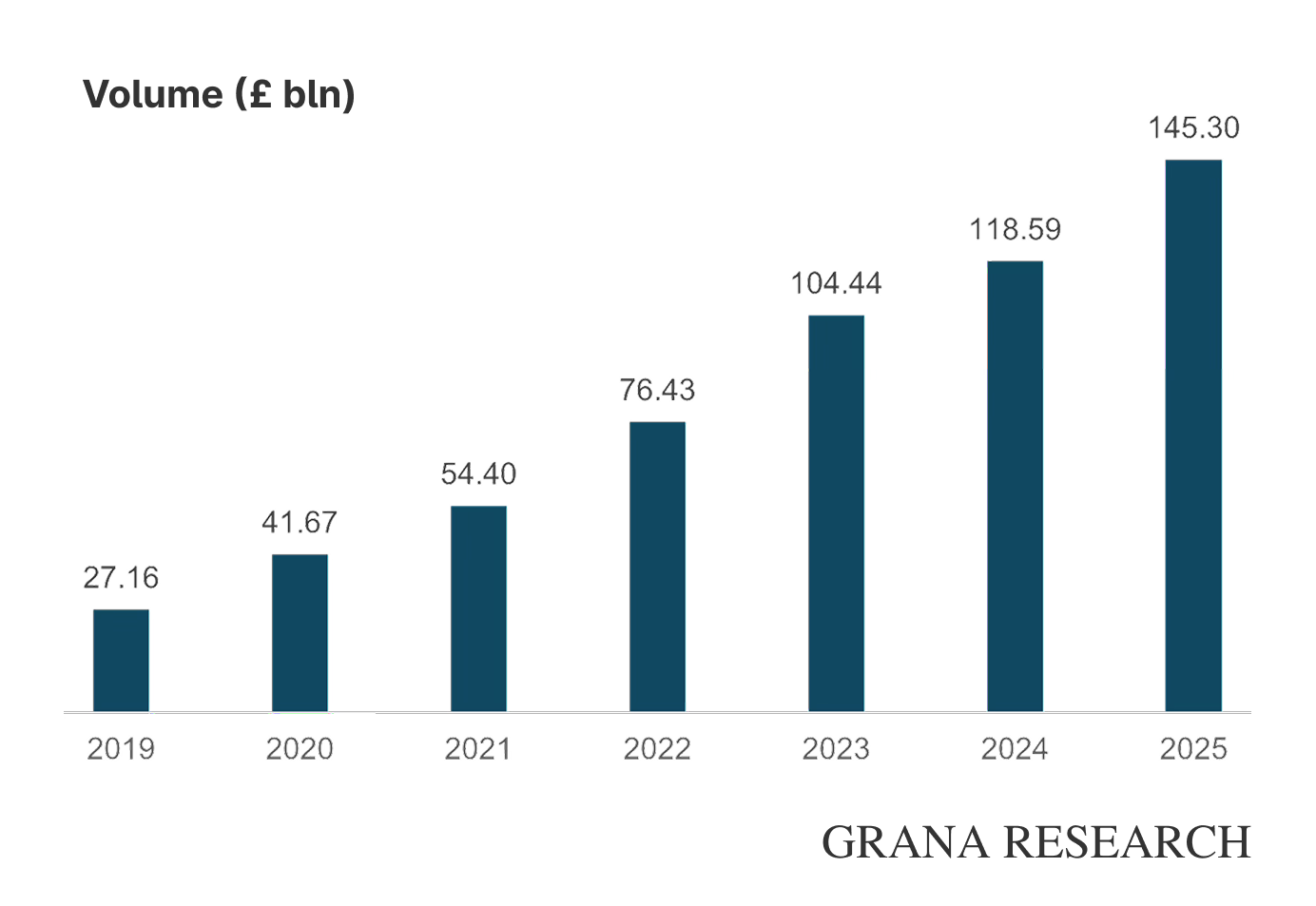

The top banks by transfer volume include JPMorgan Chase, Bank of America, Wells Fargo, HSBC, and Citi. JPMorgan is the only institution with transfer volumes exceeding $25 billion. For comparison, Wise — the largest player in the non-bank segment — transferred $145.2 billion in 2025, up from $118.5 billion in 2024 [13].

Traditional Money Transfer Operators (MTOs). This category includes companies such as Western Union WU 0.00%↑, MoneyGram, Ria (Euronet Worldwide, EEFT 0.00%↑ ), and numerous regional providers. Their infrastructure differs significantly from that of banks: MTOs have built their own global networks of agents and branches, enabling them to send and disburse cash nearly anywhere in the world within minutes.

At the core of an MTO system is a proprietary payment network. For example, Western Union operates over 500,000 service locations worldwide — ranging from urban branches to small agent outlets in rural areas. When a sender brings funds (in cash or by card) to a Western Union location, the agent enters the transaction details into the company’s centralized system. Within minutes, the information becomes available to the receiving agent, and the recipient can collect the funds almost immediately by presenting identification and the tracking number.

The actual movement of money occurs through a system of inter-agent settlements with the central company — typically using netting (offsetting incoming and outgoing flows) and periodic reconciliations between Western Union and its agents in each country. Other MTOs operate similarly.

Many traditional MTOs have expanded their infrastructure to include digital channels. Today, both Western Union and MoneyGram allow customers to send money via website or mobile app, with payment from a bank account or card, and receive funds not only in cash, but also via bank deposit, mobile wallet, or card payout. This brings their infrastructure and cost structure closer to those of fintech players.

However, the core of the MTO model remains a hybrid of a digital platform and an agent-based network. For instance, only 28% of Western Union’s revenue comes from digital channels, while 45% of its total expenses are still paid out as agent commissions [14].

Fintechs. The leading players in this category include Wise, Remitly RELY 0.00%↑, WorldRemit, as well as the fully digital segments of traditional MTOs. These providers were built from the ground up as digital and distributed platforms, with no need for physical branch networks. This gives them a structural cost advantage and allows them to offer lower fees to end users.

The core principle behind fintech infrastructure is managing local liquidity pools. For example, Wise maintains bank accounts or local partnerships in each country it sends money to or from. When a customer in the U.S. sends $100 to a recipient in India (in rupees) via Wise, the funds may not actually move cross-border. Instead, Wise credits $100 to its local U.S. account, and an equivalent amount in INR is paid out from Wise’s account in India to the recipient — effectively two local transfers.

The currency conversion is done at the mid-market rate, and Wise charges a fee on top. This creates a P2P-style liquidity pool, where funds flow through the platform without using SWIFT or correspondent banks — significantly reducing both cost and time. Other fintechs operate with similar models.

Here’s how a former Wise product manager explained the movement within liquidity pools in an interview on Tegus:

“You've got many teams in Wise who manage those liquidity pools, which means that they are forecasting and estimating how many yuan or Singaporean dollars or whatever will be needed for tomorrow. Actually, they're forecasting three, four days out. What they then do is go, "What's the likelihood of us getting pay-ins to have that amount? What is the gap? From which market should we transfer to top that up so that amount is correct for the payout estimate?" and then they make those transactions on the normal SWIFT network.

If you're looking at that, and let's just say they pay 4% for those conversions and they send maybe U.S. dollars to Singaporean dollars and they have to pay 4%, it's only about 10% is the gap. Effectively, they can turn that 4% into 40 bps because all they're doing is they're just topping up the difference. Even though they might be paying 4% to do that, because they're distributing it across the other 90% of liquidity that they had, the actual underlying cost drops down the 40 bps.”

In other words, effective liquidity pool management requires deep integration with banking infrastructure and local payment systems. Fintechs achieve greater cost efficiency in money transfers through two key mechanisms:

Digital distribution, which eliminates intermediaries at the customer interaction stage — unlike traditional MTOs, where agents act as a layer between the company and the customer, adding cost.

Liquidity management via local pools and netting, which minimizes the need for intermediaries (i.e., correspondent banks) in the actual movement of funds.

Their Margins is Our Opportunity

This quote is often attributed to Jeff Bezos, the founder of Amazon. And it perfectly captures the essence of the strategy that allowed the company to turn e-commerce — a business with relatively low barriers to entry — into a capital-intensive infrastructure “fortress.” For years, Amazon sacrificed margins in order to gain market share and strengthen its competitive moat by building a level of infrastructure that no one else could easily replicate.

In early April, during Wise’s Investor Day conference call, CEO Kristo Käärmann echoed that famous Bezos quote. Wise’s strategy in cross-border payments indeed mirrors Amazon’s approach — especially in its:

a) aggressive fee compression in pursuit of scale,

b) vertical integration, and

c) reinvestment into proprietary infrastructure.

Today, Wise has the lowest take rate in the industry (i.e., the fee it charges for international transfers). In FY2025, which ended on March 31, the average take rate for personal transfers was 0.63% (with average volume per active customer at £7.2k), while for business transfers it was 0.44% (VPC at £55.8k). The blended take rate came in at 0.58%, down from 0.67% a year earlier — a record low for the company, achieved without sacrificing operational efficiency [15].

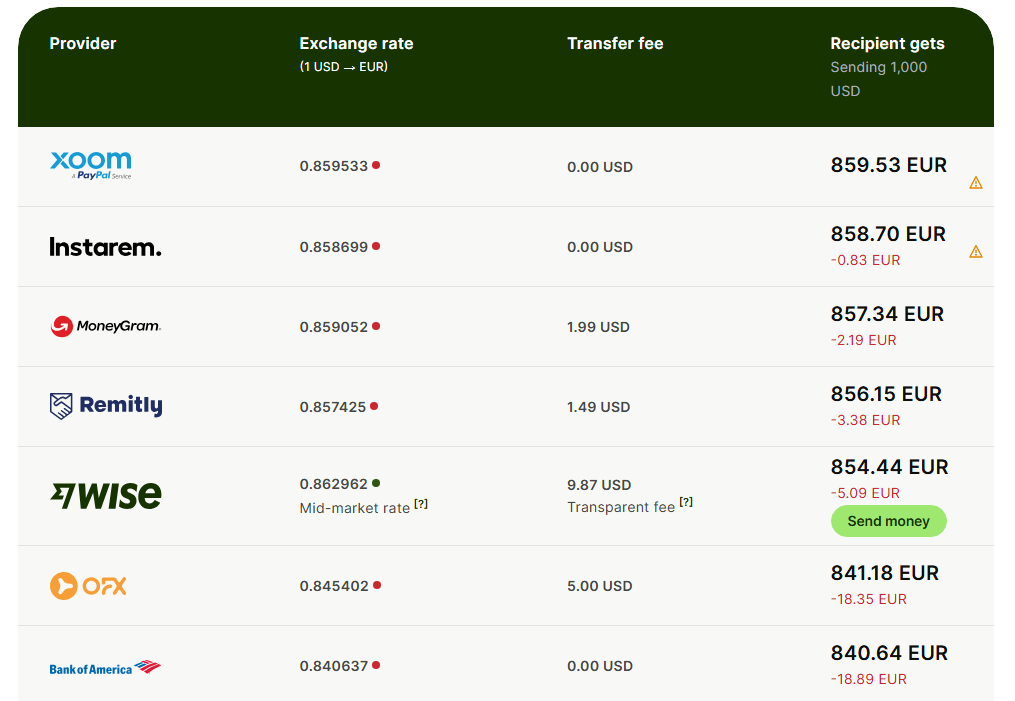

On its website, Wise maintains a public comparison tool showing rates charged by different providers across currency corridors [16]. At first glance, the market appears crowded with competing offers at comparable price points. In the “USD/EUR” corridor, for instance, Wise trails behind Xoom (PayPal PYPL 0.00%↑), Instarem, MoneyGram, and Remitly.

However, competitors often subsidize their rates in the most competitive corridors by offering less favorable pricing in other markets. Wise deliberately avoids cross-subsidization — expensive or complex routes are not financed by the more profitable ones. Each corridor must be profitable on its own.

Management believes that price reductions should follow cost reductions, not precede them.

“Our pricing is a function of our cost to serve a corridor, plus a small margin. That is why we can keep reducing prices sustainably.”— Kristo Käärmann, CEO

Wise’s take rate is significantly lower than that of publicly traded competitors.

Western Union, the second-largest player in the money transfer market by volume, maintains a take rate of approximately 3.5% [16]. Remitly — Wise’s closest and effectively only major publicly listed fintech rival — operates with a take rate of around 2.3%. Given that private fintech competitors operate at a much smaller scale, their take rates are likely even higher.

Low fees are one of Wise’s key competitive advantages. Thanks to its pricing edge, the company has been steadily gaining share in the consumer remittance market.

The massive gap in take rates is primarily a result of infrastructure — infrastructure that took years to build. Wise holds over 70 Electronic Money Institution (EMI) and Payment Institution (PI) licenses, enabling it to provide money transfer services, hold customer funds, and issue cards across various jurisdictions. The company is integrated with more than 90 local banks and 8 domestic payment systems: FPS in the UK, SEPA in the Eurozone, GIRO/AFR in Hungary, Pix in Brazil, Zengin in Japan, FAST in Singapore, NPP in Australia, and InstaPay in the Philippines. Wise is currently working on a direct connection in the United States.

Direct integration with national payment systems removes unnecessary links in the transfer chain — whether correspondent banks or payment aggregators — allowing Wise to operate in these countries as a fully-fledged settlement participant. This dramatically lowers costs and speeds up transfers. For example, following its integration with the Philippines’ InstaPay system, up to 90% of Wise’s local transfers are now processed instantly, and the base cost per transaction dropped eightfold [17].

Why don’t other players replicate Wise’s infrastructure? Traditional banks avoid doing so for two main reasons:

Money transfers account for a negligible portion of their business — roughly 0.5% of total bank revenue and around 1–1.5% of consumer banking revenue [18];

Banks rely on a mutual “barter system” of services, where informal reciprocity replaces direct integration.

Here’s how a former Head of International Payments at Barclays explained it in an expert interview on Tegus:

“Sure. Because the wallet share of correspondent relationships and reciprocity is much bigger in value for a bank like Barclays than trying to bypass them and build something new. For example, we were making circa GBP 150 million of revenue from financial institution clients — easy money. If I used Deutsche as my correspondent to send payments into Europe, I paid a lifting fee, and in return Barclays got reciprocity — Deutsche might, for instance, clear payments in the UK for us. <...> The sheer size of this reciprocity business made it more attractive to preserve the status quo.

Now imagine I bypassed Deutsche and used local balances across markets — that would remove their business, and in response they'd cut off reciprocity to us. The value of that reciprocity was still higher. <...> With the rise of Swift GPI and more visibility, this model is under pressure, but behavior hasn’t changed dramatically. Even if Deutsche charges GBP five per transaction, Barclays still benefits from the incoming Deutsche flows into the UK, and those volumes remain significant.”

MTOs cannot replicate Wise’s infrastructure due to a complex mix of regulatory, technological, and economic barriers. First, a large portion of their operations still relies on cash disbursement via agent networks, which requires maintaining physical infrastructure — a costly endeavor that accounts for roughly half of total expenses at many MTOs.

Second, the core customer base for MTOs consists of migrant workers and blue-collar earners with low volume per customer (VPC) — less than $500 annually at Western Union and MoneyGram. These transaction sizes typically fall under simplified regulatory thresholds, allowing MTOs to avoid building out their own KYC/AML infrastructure. By contrast, direct integration with domestic payment systems requires a full audit of all KYC/AML procedures before licenses can be granted.

Third, MTOs often operate at the low end of the pricing spectrum in certain corridors (e.g., India, the Philippines), where they heavily subsidize transfer fees. For them, investing $20–30 million into direct connections with national payment systems is not economically viable when the average revenue per customer is just $1–2 per year.

Notably, the One Big Beautiful Bill Act proposes a 3.5% tax on money transfers that do not go through financial institutions and are not funded via card payments [19]. The bill is intended to reduce the share of "gray" transfers that fall under simplified KYC requirements. This should incentivize MTOs to increase the share of fully digital transfers and invest in internal compliance systems. However, building a KYC/AML stack on par with Wise could take years, even with a dedicated team and sufficient capital. KYC/AML is not just about technology — it involves reporting processes, independent audits, and coordination with Financial Intelligence Units (FIUs) and tax authorities.

Here’s how the company’s management explained the difficulty of replicating its infrastructure during the latest Investor Day:

“So the first part of the question about whether the progress that we make in these direct connections, is this making it easier for newcomers? The answer is yes and no. Yes, in the sense that all our efforts with policymakers, with the regulators at the G20 level as well is making progress towards removing this barrier entry to their payment systems that traditionally was reserved only to banks. <...> And of course, when the regulation changes, when the law changes, it changes for everyone. <...> And as I was explaining, it is not for everyone. It is not for every nonbank financially regulated institution. That is the first step, getting this license.

And once this license comes in, it goes -- we go through a process with a payment network that requires really high standards from a technology, from an operational perspective, requirements around the type of servers or cloud based around our resilience, our business continuity plans. <...> Also the difference is we already have a very strong head start. We have done this in 6 countries. We are about to go live into more. <...> I think it's a very good example that this year, we are delivering to one in Brazil and the other one all the way in Japan.”

Also notable are the comments from Wise’s former Head of Pricing and former Senior Product Manager on how difficult it is to replicate the company’s infrastructure and cost structure:

Tegus Client

We talked about why no one has been able to copy Wise's cost structure. Right now, no one has been able to copy Wise's cost structure. But if you look at three or five years, what is the likelihood that Wise still has such a unique advantage in its cost structure relative to peers?

Former Head of Pricing at Wise

I think if there would be a company that would go full speed on, and they would really focus only on the cross currency, not on all the other features that all the competitors are trying to launch at the same time, they could get to a place where they would start to get a little bit closer to the cost structure. But Wise has too big of advantage.

They're like different cost structures and different ones require very different skills and efforts to optimize. But even the most common example is the bank fees. So all of these challengers who would want to essentially process conversion, they need to have partnerships with banks. And having partnership with banks, the commercial model is much higher than the commercials you get if you directly integrate within a payment system.

To give you more like a tangible sense of what this means, it's more than 10x different, what you pay if you're directly integrated versus if you pay to a partner. So these direct integrations, they take a long time and licenses, and Wise has couple of them already. So just to level the playing field on this one cost item would already buy Wise many years.

Tegus Client

That's interesting. On the point about the central bank integrations, how difficult is that? A big part of Wise's infrastructure is using domestic payment systems, presumably that is something that competitors can still do, so just trying to understand.

Former Senior Product Manager at Wise plc/ADR

Every time Wise does a direct bank integration, they're opening the doors for Currencycloud to follow, because the Wise approach goes through regulatory rehashing of what the rules are. Why can a fintech like Wise be allowed in there, even though they're not a bank? How can they work within those systems? Wise goes through lots of lobbying, lots of conversation, takes years in most markets. The U.S. one is still ongoing and it's been ongoing for a long time. Those things take time.

Once it's done, they're opening the doors for any competitors to catch up, but no one's taking them up on that yet. I think once they realize, then they've got all these markets that was already existent and then they can try and maybe lead in some other market. If they do, then it also opens the doors for Wise. It's not cheap to do. It's not something that I've seen anyone adopt as a strategy apart from Wise.

Tegus Client

Again, supposing that they did try to replicate that, is it still a case that Wise just has the scale of volumes, that the price still wouldn't be competitive? I don't know where volumes would compare versus, say, Currencycloud?

Former Senior Product Manager at Wise plc/ADR

Let's go back a step. The biggest money maker is having £1,000 and €1,000 in the bank at the same time and being able to pay out whoever needs to pay in or pay out the exact amount without having to convert anything, because then you're just paying for the servicing cost, which is your AMLs, your RegTech stuff, your compliance things, your customer support, your chargeback costs, your infrastructure, your AWS bill, that's all you're paying for.

Wise is able to do that in many markets. They don't actually have to exchange. The moment they do have to exchange, that's when they start paying some fee to someone who's helping them with that, or if they've got those liquidity buckets, then they're paying themselves a reasonable fee.

For Currencycloud or anyone to get up to that point, they have to build those liquidity pools. They have to have those inflows and outflows balanced as close as possible. They have to have really robust hedging solutions for the forex fluctuations. If they do want to offer a rate lock like Wise does, if they don't, then they can save money there like Revolut does. There's lots of things where they can move. To really get down to that lowest cost, you need to be optimizing all those areas, the customer support, the transactions, the handling, the liquidity, all of those things.

The central bank integrations help with that. There's a big factor there, because you get to drop the banking partner. That means that you are predictably a bank in that region, which means you've got access to that cash and you don't have to pay any extra markup for those. That is a huge cost. That's half the cost in most other markets.

Most of Wise’s competitors still rely heavily on partner banks and third-party aggregators. Direct, full-stack access to payment systems is rare, and Wise is several years ahead in this regard. However, a number of fintech providers — including Airwallex, Nium, and Currencycloud (Visa, V 0.00%↑) — are working to build similar infrastructure.

The closest comparable is Nium, as it operates in both the consumer and business segments, like Wise. However, Nium is significantly smaller: in its most recent funding round, the company was valued at $1.4 billion — 30% below its 2022 valuation — and processes around $25 billion in annual transactions, compared to $199.2 billion (£145.3 billion) for Wise.

Wise also competes with Airwallex in the business segment, where the latter processes about $130 billion, versus $53.4 billion (£38.9 billion) for Wise [20]. The companies have comparable take rates — 0.39% for Wise vs. 0.55% for Airwallex — though it’s worth noting that Airwallex’s volume includes acquiring, which may skew the figures. Also worth mentioning: only 22% of Wise’s revenue comes from the business segment.

An executive officer at a fintech company offered a concise comparison of the two firms. In his view, Wise and Airwallex target different client profiles. Wise is stronger in serving banks and fintechs, offering deeply integrated solutions and access to local payment rails, while Airwallex more often serves corporate clients in e-commerce, travel, and B2B services:

Tegus Client

Given that you mentioned Wise and Airwallex sometimes can be head-to-head competition, is there a rough win rate for you when you're encountered with Wise? What is the typical scenario that you will win over Wise or vice versa?

Director - Strategy & Operations | Executive Office at a Global FinTech Company

Yes. I don't have that. Maybe commercial team track that I don't. Wise is very stronger when it comes to offering their product on the infrastructure side to banks and other fintech’s. Even if you go on their website and click on the platform part, not the personal business but the platform part you will see their focus is that "Okay, the power banks, the power fintech’s and the power enterprises."

Versus Airwallex is stronger in powering the enterprises versus banks and fintech’s. I think it's just by the way of design that how they have built their infrastructure business. If you've seen recent press releases, I think now they're powering some currencies for Standard Chartered. I'm talking about Wise and now they're also powering payments for Morgan Stanley.

If you can see, with just these two press releases and also from the past, most of their big customers are in the banking and the fintech space, financial services space versus Airwallex's customers are very diverse but mostly from the e-commerce space, travel segment, wealth management, professional services.

They are powering. You can say they are more popular among the enterprises who want to become fintech’s by leveraging our infrastructure but don't have their own financial services business yet versus Wise is stronger on the other side. That's one difference.

The other thing is as I mentioned, Airwallex also offers acquiring. If an infrastructure wants card acquiring in their product mix, card acquiring or local payment methods acquiring, then they tend to work with Airwallex versus Wise.

That's one of the other advantages that they have. Wise is stronger when it's competitive fintech’s and banks and Wise may have I would say more direct connections for the banks for the local payment rails versus Wise and I think it's just because they started way before us. Yes, that's the focus. For major currencies now Airwallex also competes with Wise for that.

Currencycloud is a B2B platform for international payments, serving banks, fintechs, brokers, and enterprises. It operates via APIs and white-label solutions, enabling clients to quickly launch financial products while outsourcing much of the backend — including compliance and KYC — to Currencycloud. The company is particularly notable for being a Visa subsidiary and for powering the payment infrastructure behind European fintech giant Revolut [21]. Wise competes with Currencycloud in its platform offering (a subset of its business segment), which currently accounts for less than 5% of the company’s TPV.

While Currencycloud processes around $100 billion in transactions annually, a former senior product manager at Wise notes that the company still lags significantly behind Wise in terms of infrastructure, and that its take rate is roughly twice as high:

Tegus Client

Currencycloud, would you say they're the biggest competitor on the platform side before they were bought?

Former Senior Product Manager at Wise plc/ADR

Yes. I don't see anything good coming out of it since the acquisition. For me, it's a very stagnated product, and I don't understand why.

Tegus Client

Do you have any idea of the overall experience between the two platforms now? I don't know how the fees might look and I have no idea really how what the fee rates will be for Wise. Presumably, it will differ for each customer, but in general?

Former Senior Product Manager at Wise plc/ADR

I would say in general, double. Especially on the embedded routes where there is a central bank integration, Currencycloud is way over 1%. They can't even get below that because they're still reliant heavily on banking partners, but in those other areas where Wise had central bank integrations, they're really able to do 30 bps, 40 bps, just on the consumer level.

You've got additional discounts depending on the client that you get on board. If they take on the customer service and support role and they're doing that internally, then again, they're getting a much better rate because then Wise isn't offering that as a service. There's a lot of leverage there further. I would say, even on those routes, it could be 3X or 4X cheaper than Currencycloud can even offer without subsidizing.

Interestingly, according to him, Currencycloud was once considered the gold standard — and Wise lagged far behind. But today, the situation has changed dramatically:

Tegus Client

You paint a pretty bleak picture of Currencycloud then by comparison between two.

Former Senior Product Manager at Wise plc/ADR

It was the gold standard. The other thing that they did really well was they were able to plug things in quickly. Wise, it took years from an initial conversation to getting things on the rails. I know my team worked on a component of that which reduced things from nine months to a month, and it took us 18 months to build. I know how far behind Wise was.

When you now look at them achieving parity and then having these central bank integrations, plus the liquidity pools of having money coming in on those locations and real time in the amounts that they need them, through very targeted marketing, through very targeted customer relationship building, that is like a secret sauce that Currencycloud never even attempted to pick up or try and replicate.

They were just saying, "Look, here's what we can do. Here's the cheapest we can do it. Here's how you can integrate." It did the job, which everyone got excited and rightly so, because they went from something that cost 4% to something that cost 1.5%. That's revolutionary. They just lost their edge. I don't think it's completely bleak. I think they can still wake up and start playing the game. I think they just celebrated the acquisition and dropped the ball a bit.

Wise’s infrastructure is unique in its combination of depth and scale. As a result, the company has virtually no direct competitors in terms of transaction cost structure. Moreover, Wise continues to deepen its competitive moat by deliberately lowering its take rate as it scales. Management has publicly stated its long-term goal of making international transfers free. In other words, the ambition to be the cheapest and most transparent cross-border payment provider is not just a strategy — it’s part of the company’s founding culture.

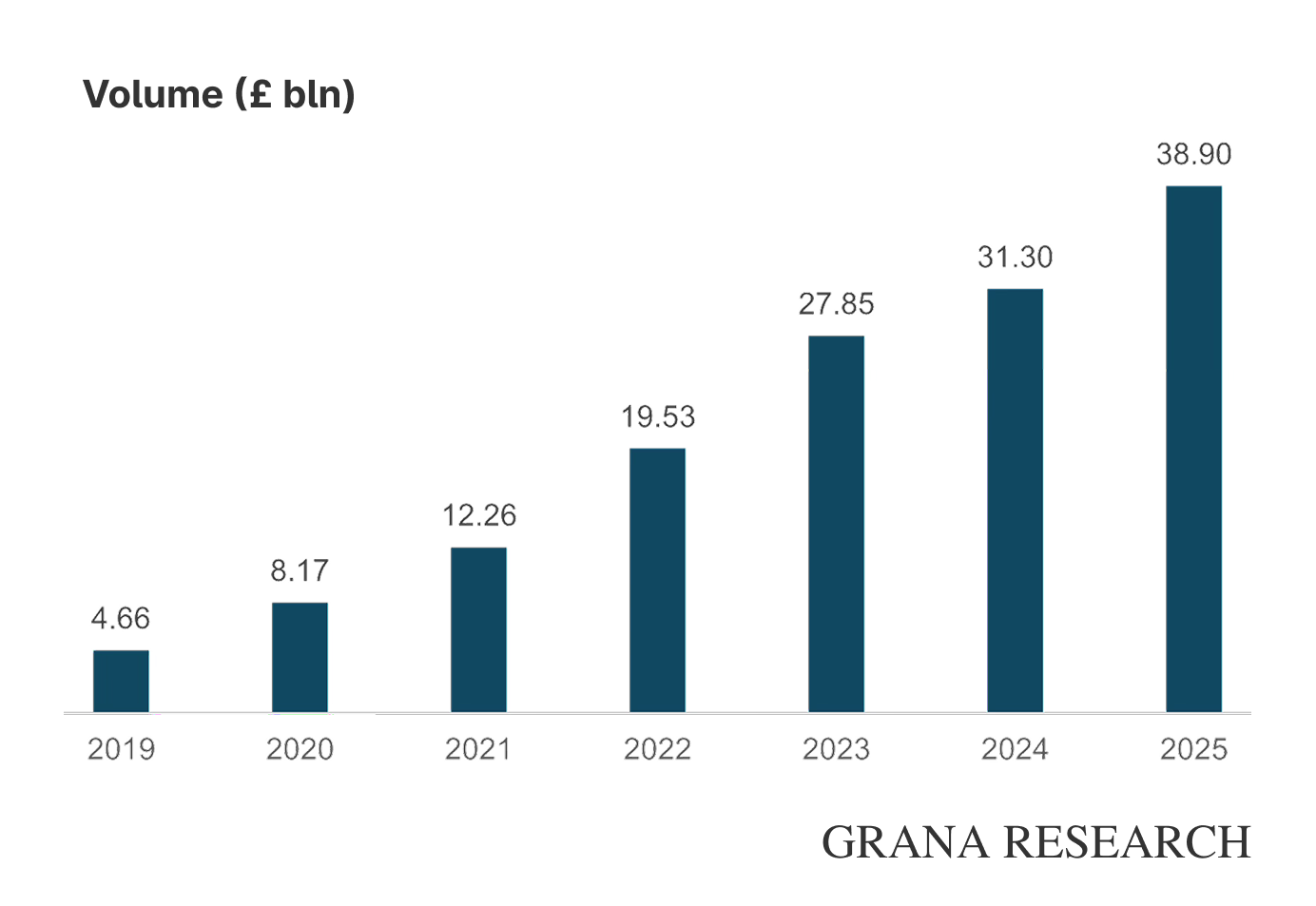

And the strategy is working. Over the past five years alone, Wise’s active user base has grown 2.6x, reaching 15.6 million, while cross-border transfer volumes have increased 2.7x.

Around 67% of new customers join Wise through referrals and recommendation links shared by existing users. Amusingly, after Wise was discussed in one of our internal investment committee meetings, our trader turned out to be a customer — and promptly dropped his referral link into the team chat.

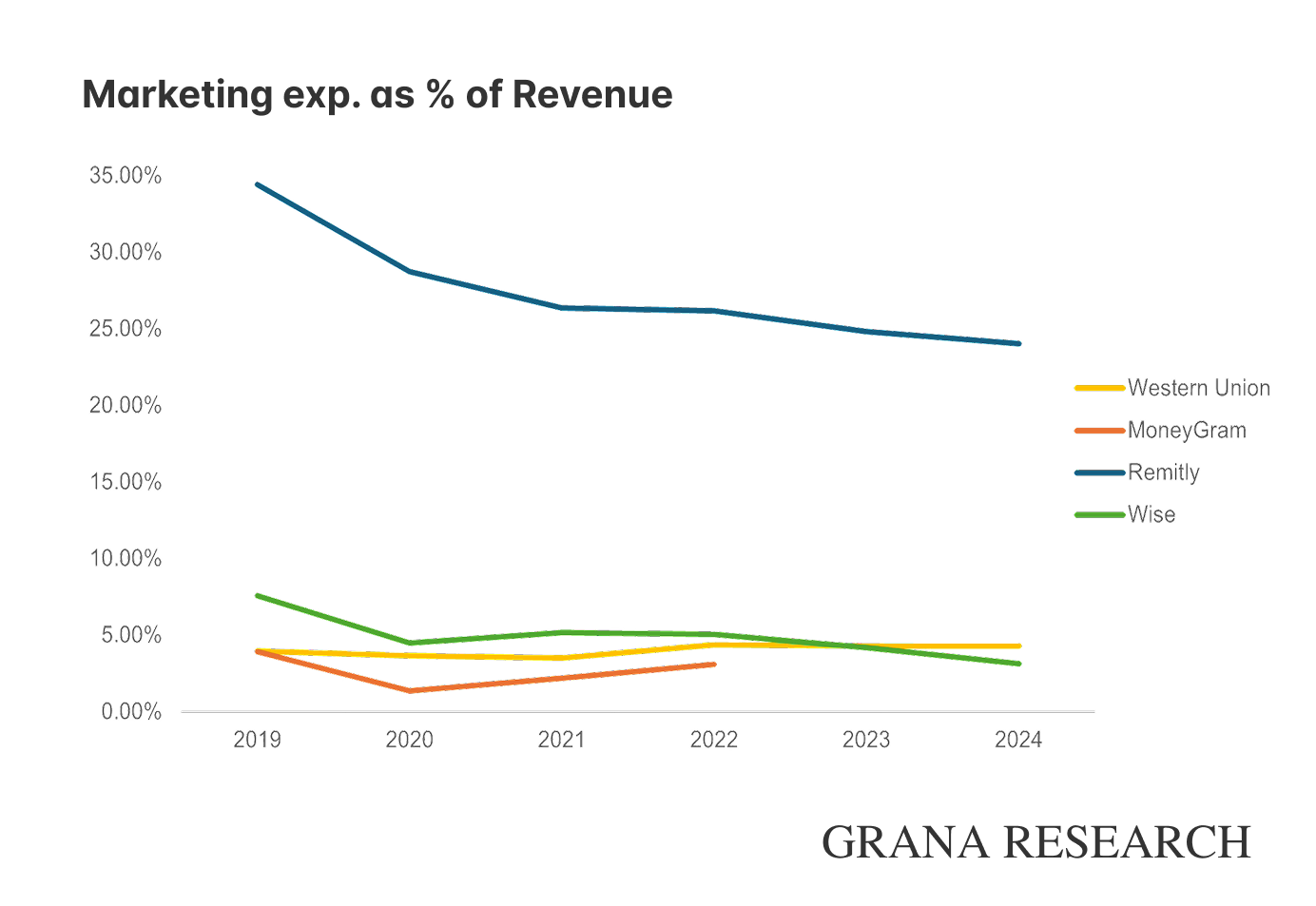

The company relies heavily on word-of-mouth growth rather than expensive marketing, which helps keep operating costs low. Despite increasing its marketing budget by 47% year-over-year in FY2025, total marketing spend amounted to just £53.8 million. Meanwhile, operating margin reached 47.8%, and the marketing-to-revenue ratio remains among the lowest in the publicly listed peer group.

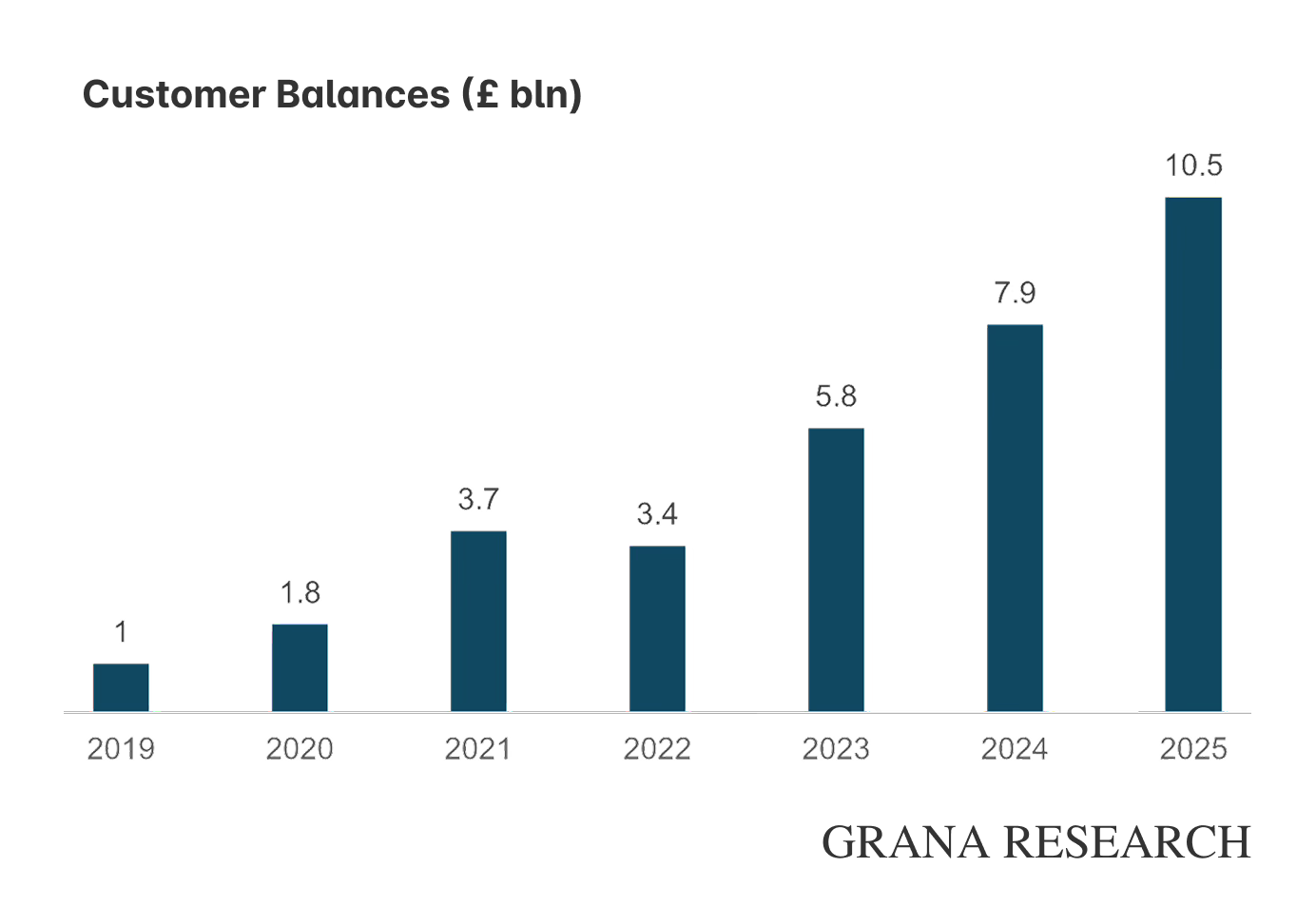

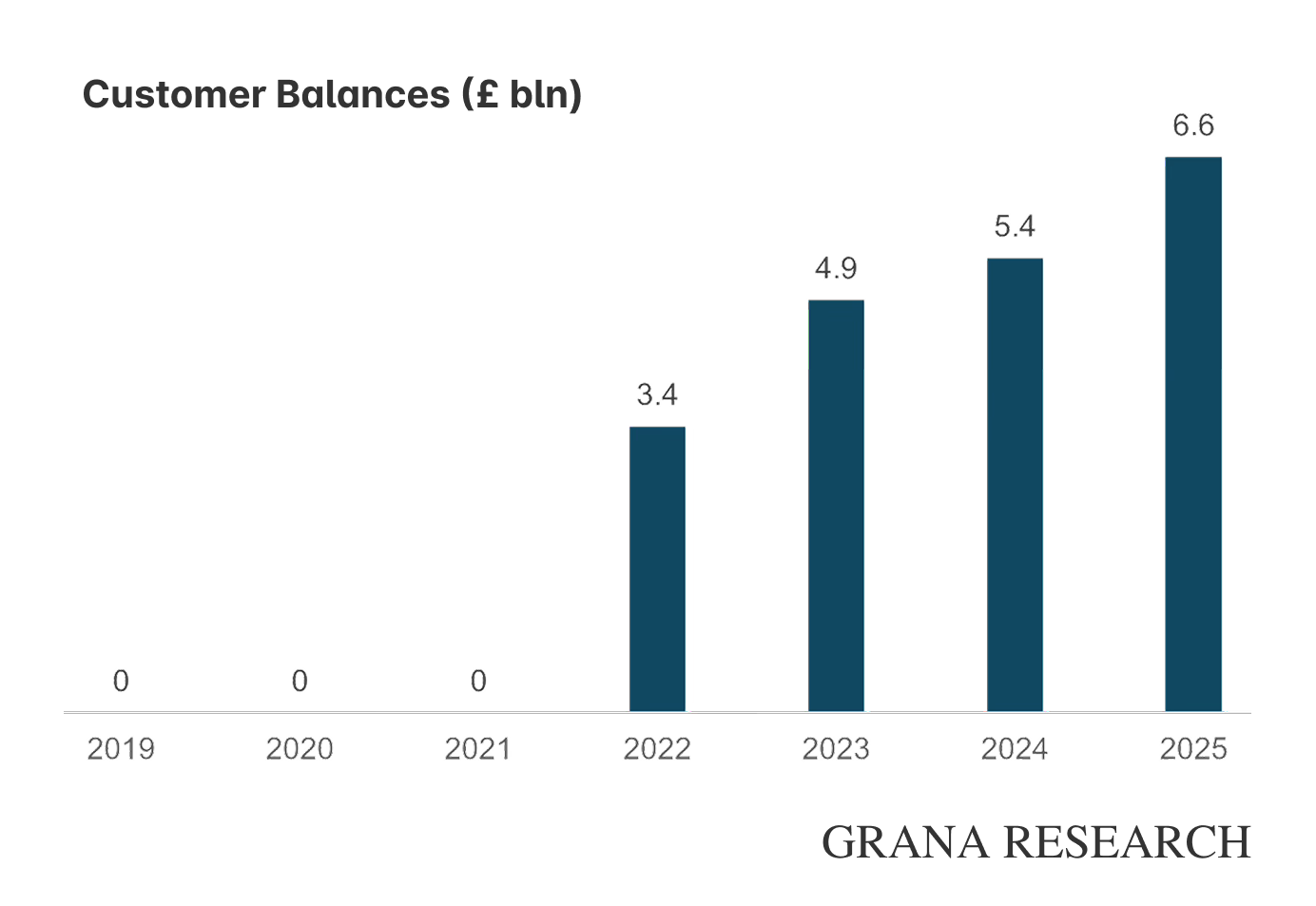

As more users not only transfer money but also hold funds in their Wise accounts, interest income is becoming an increasingly important part of the company’s business model. In FY2025, interest income from customer balances totaled £594.3 million, compared to £840.4 million in cross-border revenue and an additional £371.5 million from card and other income. By year-end, total customer balances exceeded £17 billion, with £10.5 billion held by personal users and £6.6 billion by business clients.

This structural shift strengthens the resilience of Wise’s model: the more funds customers keep in their accounts, the higher the interest income — which the company can reinvest into further take rate reductions. But more on that in the next section.

To summarize, here are the key ingredients behind Wise’s low pricing:

a well-developed proprietary infrastructure and direct integration with national payment systems;

low customer acquisition costs driven by a high share of organic traffic;

a growing volume of customer deposits.

Together, these factors form a resilient business model that enables the company to reduce its take rate without compromising profitability, while simultaneously widening its competitive moat. The low take rate, in turn, drives growth in transfer volumes and increases the balances held in Wise’s multi-currency accounts — a key source of interest income. This creates a self-reinforcing cycle: lower fees stimulate higher transfer volumes, which in turn allow Wise to lower prices even further — making its offering increasingly competitive over time.

Business Model and Growth Drivers

Wise operates across several interconnected segments, all built on a single platform but targeting different customer types and use cases. From a customer-type perspective, the company distinguishes the following segments:

Personal (B2C). In this segment, Wise provides individuals with a platform for international money transfers, multi-currency storage, and usage — all with minimal fees and currency conversion at near-market rates. Customers can open accounts with local bank details in multiple currencies (Wise Account), receive cross-border transfers, convert currencies, and spend using a Wise debit card.

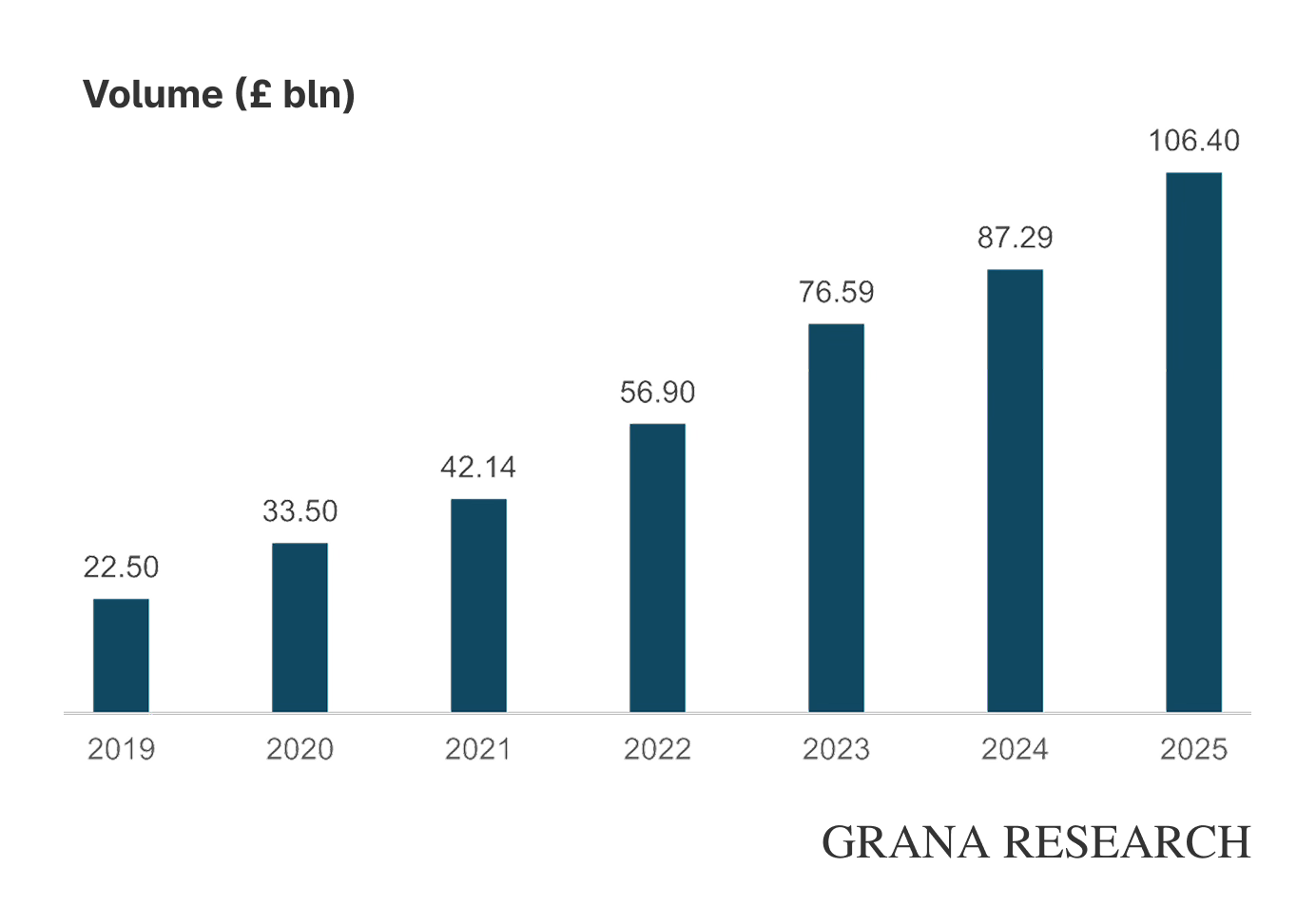

The segment serves 14.9 million active customers. In FY2025, they transferred £106.4 billion in total, or about £7.2k per customer — accounting for approximately 73% of total volume. The aggregate balance held in Wise Accounts within this segment stood at £13.4 billion (averaging £899 per customer).

Wise earns revenue through transfer fees, and card-related fees such as a one-time card issuance fee, interchange, and ATM withdrawal fees beyond a free limit.In Q1 FY2026, the cross-border take rate was 0.57% (vs. 0.63% in FY2025), and the card and other take rate was 0.26% (flat vs. FY2025), resulting in a total take rate of 0.83% (vs. 0.89%). In addition, Wise earns interest income by investing customer balances in liquid assets. The Personal segment accounts for ~78% of total revenue and underlying income (revenue + interest income on the first 1% of balances).

Business (B2B). Wise’s B2B segment offers small and medium-sized businesses a multi-currency financial platform for cross-border payments, local account details in multiple currencies, payouts, international revenue management, and FX conversion at interbank rates with low fees.

The segment serves 697,000 business customers, who transferred a total of £38.9 billion, or roughly £55.8k per customer. The total B2B balance reached £6.8 billion (~£9.76k per customer). The monetization model mirrors the B2C segment: Wise charges transfer fees, applies card fees, and earns interest income on deposited funds. In Q1 FY2026, the cross-border take rate was 0.39% (vs. 0.44% in FY2025), the card and other take rate was 0.23% (vs. 0.24%), and the total take rate was 0.62% (vs. 0.68%).Wise Platform (B2B2C, part of Business segment). This is Wise’s infrastructure-as-a-service product, allowing third-party companies to embed Wise’s cross-border payment capabilities via API-based white-label solutions. It is used by banks and fintechs that prefer to leverage Wise’s infrastructure and licenses instead of building their own global banking integrations. Currently, the platform generates a modest share of total volume — less than 5%.

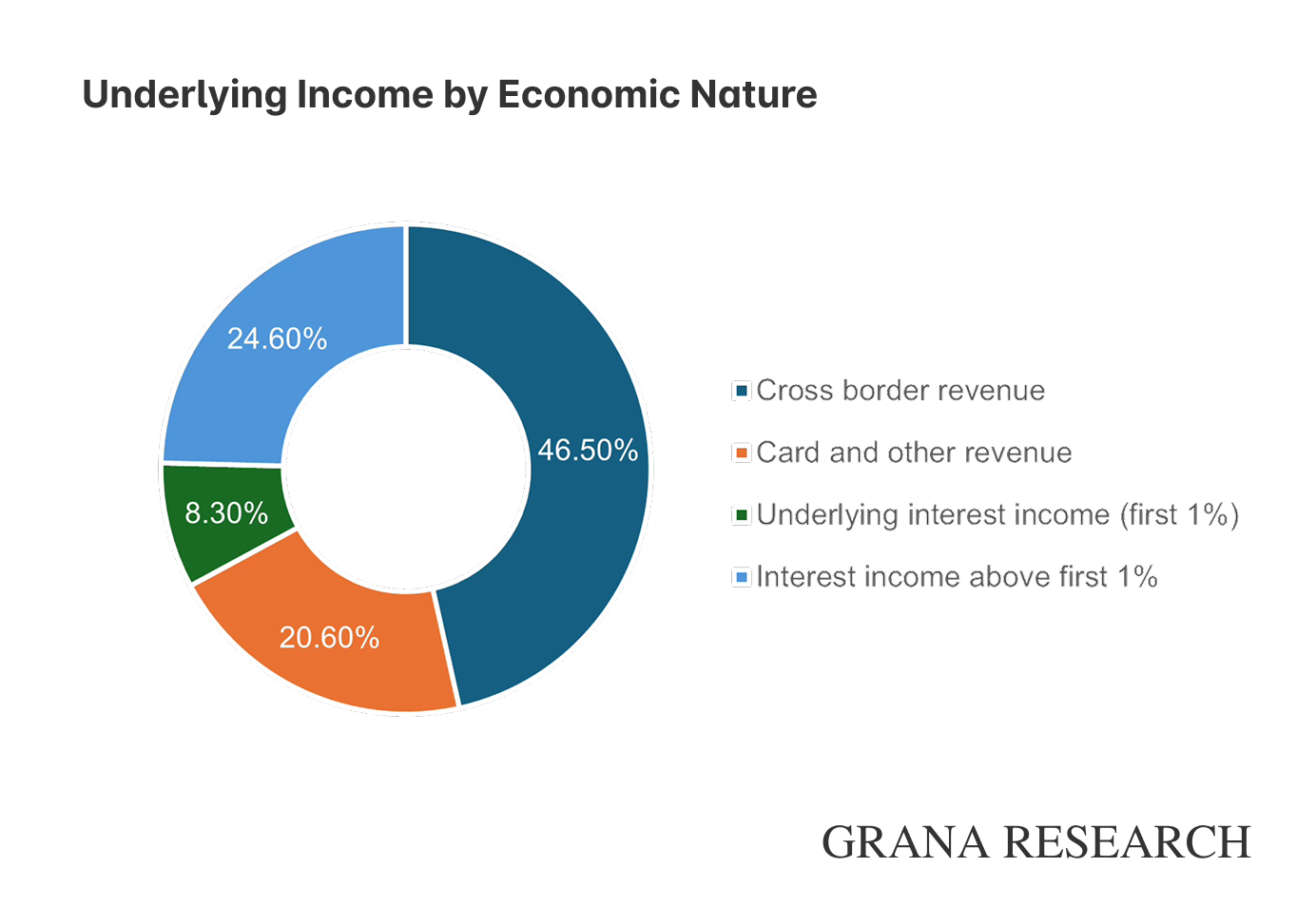

From a revenue composition perspective, Wise categorizes its income as follows:

Cross-border revenue: 46.5%

Card and other revenue: 20.6%

Underlying interest income (first 1% of balances): 8.3%

Interest income above 1% threshold: 24.6%

The full revenue breakdown is shown below:

The B2C segment has always been the company’s primary growth driver.

Since 2019, the number of active customers in this segment has grown at a CAGR of ~28.8%, transfer volumes at ~29.4%, and revenue at ~37.2%. Total income from the segment — including both revenue and total interest income — has expanded at an impressive ~43.7% CAGR. Despite a declining take rate, the segment’s financial performance has significantly outpaced its operational metrics. A major contributor to this outperformance has been the Wise Account, a product launched in 2018 [22].

The Wise Account is the company’s flagship product and one of its core growth drivers. It’s a multi-currency account for personal users, allowing them to hold balances in over 50 currencies and convert between them at the real mid-market rate. Users can link a debit card for online payments and ATM withdrawals, send international transfers, and make purchases — all within the same account. Thanks to the Wise Account, card and other revenue grew from £7.5 million in 2019 to £279.7 million in 2025, increasing from 5% to 29.5% of B2C segment revenue.

According to our model, this share could reach approximately 48% of B2C revenue by 2030.

The Wise Account was designed to eliminate friction between a customer’s traditional bank account and transfers made through Wise. Here’s how a former financial controller at the company explains the product’s value proposition:

“The friction is getting from me in my pounds account, in HSBC, for example, into the Wise GBP account to get across the euro accounts... So you take that out and say, well, you keep a Wise account, you can have all these currencies in it. The proportion of them, you can have bank account details like your local in Australia or local in Canada or whatever. And therefore, you can get money in, and you can pay money out in all those accounts.

So that just reduces the friction of the whole flow and gives you that flexibility. And that was really the driver of it. And then when you're looking now it's billions on the balance sheet now in the Wise account because it's in the balance sheet. It's safeguarded money, it's on the balance sheet.”

The Wise Account is a key lever for lowering transfer fees and scaling the business further. The more funds customers hold in their Wise Accounts, the less frequent currency conversions become — and the cheaper transfers get. In other words, Wise uses customer funds held in Wise Accounts as a form of “localized liquidity.” These same funds also generate interest income. Total interest income from customer balances grew from £75.2 million in FY2023 to £360.1 million in FY2025.

The Wise Account has become the entry point into a broader product stack — including cards, auto-conversion, and B2B services. It helps Wise retain users, increase lifetime value, and lower customer acquisition costs:

“That was the explosive growth when Wise accounts came about... you can look back at the prospectus to see that.” — Former Group Financial Controller at Wise

Since Wise began investing in the Wise Account, product adoption has grown impressively. Roughly 53% of personal customers now use the account — up from just 24% adoption in 2022 [23]. According to Wise’s former Head of Pricing, adoption is likely to reach 70%. This would imply a near doubling of issued debit cards (as not all account users have a card), which could in turn double interchange fee revenue, currently accounting for about 10% of the company’s total revenue. These estimates are based solely on Wise’s existing customer base, without factoring in expected customer growth.

The Wise Account and debit card are also available to B2B clients, where adoption stands at ~60%, up from 49% in 2022.

Wise Business holds substantial potential as well: since 2019, active customer count in the segment has grown at a 34.2% CAGR, transfer volume at ~43.3%, and revenue at an impressive ~47.5% CAGR. As in the B2C segment, the faster growth in revenue relative to operational metrics is largely due to Wise Account adoption, which enabled card revenues to grow from 0% to 35% of segment revenue, and interest income in the segment to increase from £65 million in 2023 to £234.2 million in 2025.

Wise Business primarily serves small and medium-sized businesses (SMBs) — including freelancers, e-commerce merchants, software companies, and suppliers operating across borders. For this user cohort, international payments via traditional banks are often expensive, slow, and opaque. Wise Business addresses these pain points by offering real mid-market FX rates, transparent fees, and the ability to make instant payments. The platform allows users to create and send invoices, manage corporate expenses, and simplify payments across distributed teams — all within a single unified interface.

Since 2023–2024, Wise has been placing increased strategic focus on B2B, and the reason is clear: according to the company, SMBs transfer roughly 4.7x more money than individuals, while Wise’s market share in this segment remains below 1% [13].

Wise Platform also offers a vast runway for future growth. Through this product, Wise provides payment infrastructure that banks, fintechs, and other large enterprises can embed into their own services to enable fast and low-cost transfers. The partner retains full control over the customer experience: they display the FX rates (sourced from Wise), lock them in, initiate the transfer, and notify the end user. Wise then automatically processes the payment through its global network of local settlement accounts. In essence, Wise handles the technical delivery of funds along the optimal route, while the partner manages all customer-facing interactions.

Wise Platform clients include names such as Nubank, N26, Monzo, Google Pay, Bolt, Agoda (Booking), Brex, Deel, Spendesk, and Interactive Brokers. Notably, traditional banks are increasingly joining the platform, including EQ Bank, Itaú, Raiffeisen Bank, HSBC, IndusInd Bank, Standard Chartered, Morgan Stanley, and UniCredit. Notably, several of the most prominent banks joined the platform only recently: Standard Chartered in November 2024 [24], Morgan Stanley in December 2024 [25], Raiffeisen Bank in May 2025 [26], and UniCredit in July 2025 [32].

Today, Wise Platform accounts for approximately 4% of total payment volume (TPV).

The company’s management expects this figure to reach 10% in the medium term, and that the platform will eventually drive the majority of TPV over the long run. A former Senior Product Manager at Wise believes the Platform unlocks disproportionate opportunities for the company:

Tegus Client

Right. They talk about platforms still being very small today and they think it's going to become a big, a majority of volumes going forwards. Is that internal consistent with internal messaging in terms of really where they see the future opportunity? Should we really expect that the platform business is actually much more prosperous potentially than the majority of the consumer business that it is today?

Former Senior Product Manager at Wise plc/ADR

The focus has always been on the customers, because the customer is king. What that means is that everything is done for the customer first. Customers have funded Wise, they've invested in it, they've made it what it is today. The honoring of that is to try and give them the best possible rate in the world. The platform offering grows volume. The volume grows, that means that the consumers get a benefit of that because as the liquidity pools get bigger, as the volumes get bigger, all the underlying costs get driven down and contribute to a lower cost for them.

The platform offering has the biggest opportunity internally to grow volumes faster than anything else. That's why there's a big investment there, because signing up one big client can drive volumes in the same way as taking on a whole other country. That's where the disproportionate opportunities.

Beyond onboarding new fintechs and digital services, a clear growth driver is the potential migration of traditional banks to the platform. Given that Wise already partners with several large global banks, this scenario no longer seems far-fetched. Here’s what a Product Lead at N26 — the German neobank and a Wise Platform client — had to say on the matter:

Tegus Client

Okay. Could you imagine that the incumbents, really, the typical old banks, would move to Wise?

Product Lead at N26

To be honest, I think yes, for two things. First, on the international level, and I've been involved in a couple of discussion, there is a trial how can we move the corresponding bank into a more efficient way. There's a lot of progress in some of the corridors. In Europe, they are trying to do the SEPA instant scheme, one-leg transfer out that basically when you want to transfer funds externally, the payment doesn't go via SIWFT, it could be a SEPA instant until the corresponding bank to make it more efficient and cheap.

There's also similar things in the U.K. and U.S. We have these three big currencies all creating the infrastructure to leverage how the money can flow across continents. However, for the small currencies or the long tail, I think this infrastructure will not be in place for next 10 years which always going to grant why isn't social similar to them an edge compared to incumbent spending.

I believe that as the digital nature of this generation of millennials go to the premium of wealth into the business size more and more, they are aware of how these native digital solutions are built and how trusted they can be, increasing the overall volumes of Wise into the future. With this, I think once they see the drop or the volumes, incumbent will see, "Okay, what can we actually integrate to maintain a competitive offering and retain part of their business model revenue?" I think Wise going to be in the front line.

It’s worth noting that N26 initially partnered with Banking Circle, but the competitor’s infrastructure proved less mature: the promised FX functionality was not fully available, and implementation timelines kept slipping. As a result, N26 switched to Wise Platform in early 2024.

Thanks to its robust product ecosystem and unique infrastructure, Wise has multiple growth vectors. The B2C segment remains the company’s core business, with the Wise Account driving growth in customer balances, card revenues, and interest income. The B2B segment (Wise Business) also holds significant potential, given that the corporate money transfer market is much larger in size, while Wise’s current penetration remains low. Finally, the scaling of Wise Platform delivers a disproportionate contribution to TPV, lowers unit costs, and amplifies network effects. Together, these three segments reinforce one another, positioning Wise as a resilient and highly scalable business with a long runway ahead.

Financials and Valuation

The financial analysis and valuation section is typically the least exciting part of any investment thesis. However, it’s precisely the work with numbers that provides the clearest picture of how the business operates — and where its growth levers lie.

You can view and download our financial model via the link. The model includes seven key tabs:

DCF – a full discounted cash flow valuation with sensitivity analysis;

Multiples – historical and projected profitability metrics and valuation multiples;

Growth – historical and forecasted trends in core operational and financial indicators;

Inputs – detailed past and projected operational metrics by business segment;

IS / BS / CFS – consolidated income statement, balance sheet, and cash flow statement for historical and forecast periods.

The core assumptions are outlined on the "Inputs" tab, as well as at the bottom of the Income Statement, Balance Sheet, and Cash Flow Statement pages. Assumptions are highlighted in yellow. Our projections are based on a combination of historical trends, management commentary, and our own estimates.

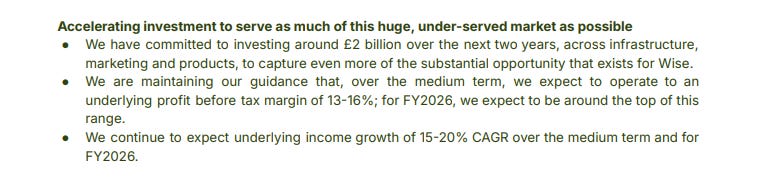

Following the latest reporting period, Wise provided guidance indicating that it expects underlying income (revenue + interest income on the first 1%) to grow at a CAGR of 15–20% over the medium term and for FY2026. Wise also expects to operate with an underlying profit before tax margin of 13–16%, and for FY2026, management expects to be near the top of that range. The company additionally reaffirmed its commitment to investing ~£2 billion into infrastructure, product, and marketing over the coming years [27].

Management guidance implies a 7.3% year-over-year decline in underlying profit before tax in the optimistic scenario (assuming 20% YoY growth in underlying income and a 16% underlying PBT margin), and a 29% YoY decline in the downside case (15% YoY income growth and a 13% margin). It’s worth noting that in Q1 FY2026, underlying income grew by 11.2% YoY. The slowdown was primarily driven by a 19% YoY drop in cross-border take rate, from 0.64% to 0.52%.

In building our model, we followed a conservative approach. We forecast underlying income growth of 14.9% YoY and an underlying PBT margin of 16.2% for FY2026 — 21 bps above the upper end of management guidance.

It’s worth noting that we model administrative expenses of £1.86 billion (excluding D&A) and CapEx of £54 million over the next two years, which is roughly in line with the company’s expected £2 billion in investments (Wise is not a capital-intensive business; most of the investment will flow through the P&L). Approximately 57% of administrative expenses are projected to come from employee benefits.

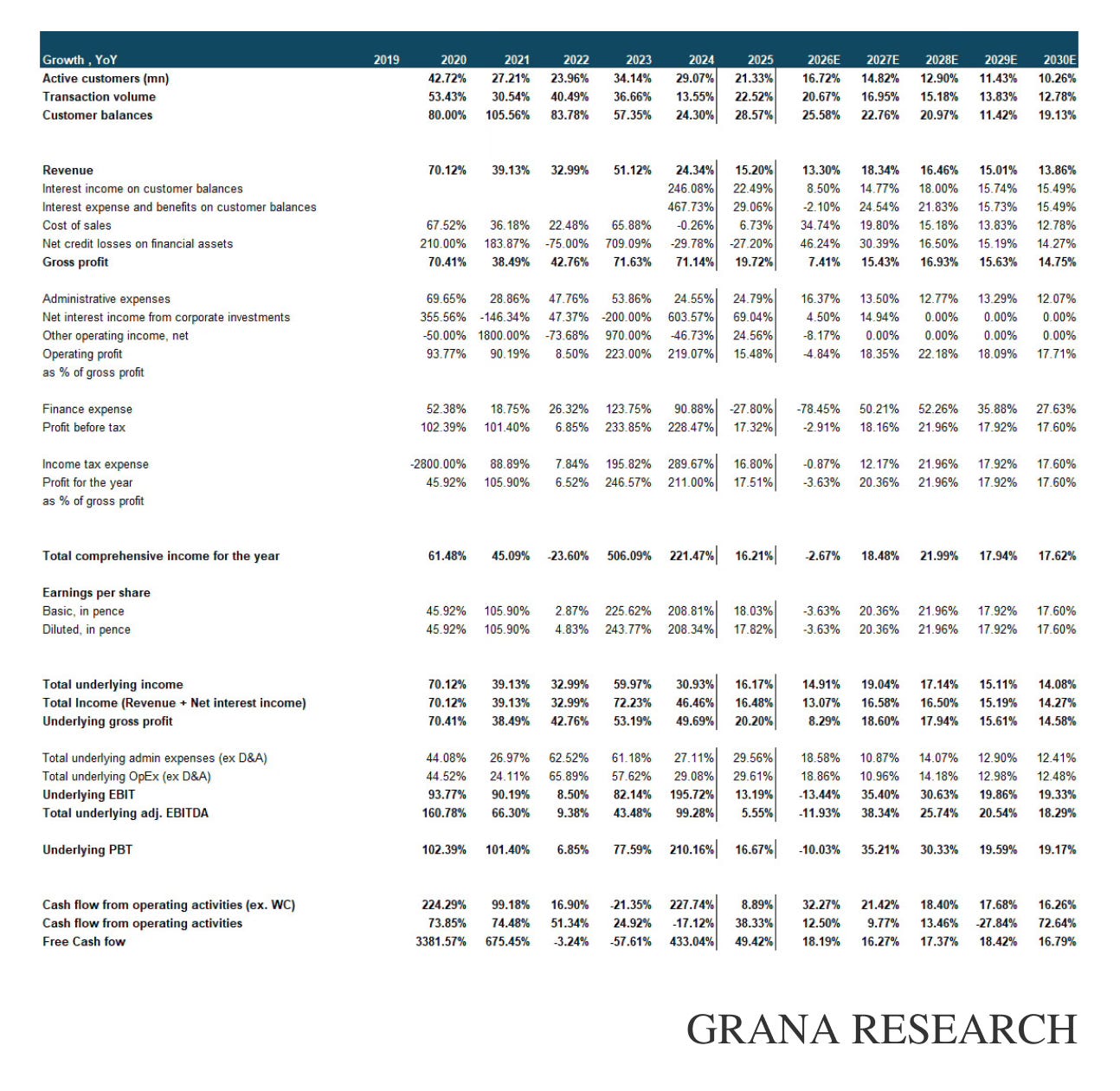

Projected trends in operating and financial performance are outlined below:

Based on our model, underlying PBT is expected to decline by 10% YoY in 2026, compared to 16.7% growth in 2025. The anticipated decline in bottom-line performance and margin compression may put pressure on the stock in the short term.

While Wise trades at a premium to most remittance peers, we believe the current valuation levels are reasonable for initiating a position: the company is trading at a 2025 FCF yield (to EV) of ~4.61% and a 2026 FCF yield of ~5.84%, with expected Free Cash Flow growth of 18.2% in 2026 and an estimated FCF CAGR of ~17.2% through 2030.

Valuation multiples are shown below:

According to our DCF valuation, the fair value of Wise shares is approximately £13.2, which is about 28% above the current price.

Sizing: we are initiating approximately one-third of the position at the current price, targeting a maximum allocation of ~10% of NAV.

About Crypto Risk

Crypto is arguably the most prominent risk factor that concerns investors in fintech. The market is constantly seeing the emergence of new crypto startups aiming to disrupt traditional MTOs and fiat-based fintechs — from the launch of Ripple in 2012 to Coinbase’s crypto remittance platform in 2022 [28], and Kraken’s launch of Krak in June 2025 [29].

And while crypto enthusiasts promise cheap, instant, and decentralized money transfers, crypto startups have failed to capture even 1% of any segment of the market. The reasons behind this failure go deeper than just regulatory barriers:

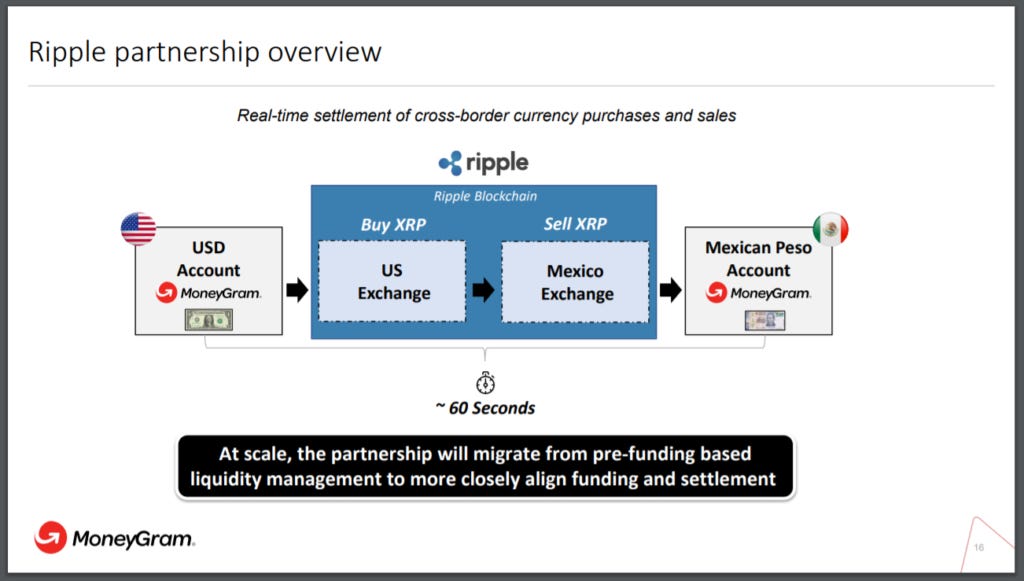

The last-mile problem. The end recipient doesn’t need a token — they need money. Receiving USDC, XRP, or Bitcoin isn’t enough. The token must be exchanged, cashed out, or spent somewhere — all of which introduces additional transactional costs. A textbook example is the Ripple–MoneyGram partnership from 2019 to 2021 (Ripple even acquired a 10% stake in MoneyGram) [30]. The transfer process worked as follows:

Instead of directly converting fiat currencies, MoneyGram was buying and selling XRP — the cryptocurrency issued by Ripple. Due to the relatively low trading volume of XRP, its FX spread was significantly higher than that of fiat currencies — and the spread had to be paid twice.

Another example is the partnership between Coinbase and Remitly, launched in 2022. It aimed to solve the last-mile problem. While the exact FX margin under this partnership is unknown, Remitly’s CEO noted that the deal is highly profitable for the company:

“And I can't talk about Coinbase specifically, obviously. But what we like about that business is the fact that from a profitability perspective, it's very advantageous to us and their strategic benefits to more transactions flowing through our system because it gives us more leverage with our partners the ability to invest more in our network, which helps both our remittance consumer business as well as the overall RFD offering. So mix of fee and foreign exchange generally with a nice profitability profile on a unit economic basis for that business.”

Thus, the last-mile problem has so far always been solved the same way — by involving traditional MTOs or fintech companies. So the question is: what value do crypto providers actually add in such operations? Arguably, it’s mostly marketing.

The question of economic feasibility. Decentralized systems rely on miners or validators to operate, and these participants must be compensated for processing transactions. Of course, fees on networks like Tron or Solana are negligible (less than $0.001). However, MTOs and fintechs also incur very low costs for moving money internationally. For example, Wise pays bank and partner fees amounting to just 0.2% of volume. Theoretically, even if these costs increased several times over, Wise could absorb them without significantly impacting its margins.

The majority of expenses for MTOs and fintechs are related to payments for receiving and disbursing funds, customer acquisition, customer service, risk management, and KYC/AML compliance. Even if new operators emerged with blockchain-based infrastructure, they would still face the same cost structure. And given the last-mile problem and additional transactional costs, their take rate would likely be significantly higher than Wise’s.

Thus, as of today, crypto does not pose a meaningful risk to Wise. It offers a weak value proposition — both for end users and as an infrastructure solution. Any savings on network fees are marginal compared to the FX margin from double conversions. It’s worth noting that Wise’s management is regularly asked about the risks they see in crypto. Here’s what Kristo Käärmann said on the topic in November 2024:

Analyst

This past month, we saw Stripe do an acquisition in the Stablecoins space. Just curious how over the next, I don't know, 5 years, you think Stablecoins will play a role with Wise?

Kristo Käärmann

I can't -- every time there is a crypto or stable coin question, I think our opinion hasn't changed, that if we see something that enables the movement of funds faster, cheaper and more conveniently, we will totally consider that. So the stance hasn't changed. But we also have nothing to report that we would have seen anything interesting. So I believe their circumstances are maybe perhaps why they did that acquisition. Must be something different than ours.

Conclusion

Wise is a rare example of a company that doesn’t just compete in a vast and fragmented market — it is fundamentally reshaping it. Through years of infrastructure investment and consistent fee reduction, the company has built a resilient model with a deep competitive moat. Direct integration with local payment systems, organic customer acquisition, and a scalable operating model enable Wise to lower prices while remaining one of the most profitable players in the sector.

The core of Wise’s model is a self-reinforcing cycle: lower fees drive higher transfer volumes, which in turn enable further price cuts, making the offering increasingly competitive. This strategy cannot be easily replicated without comparable scale and years of infrastructure development.

At the same time, Wise remains founder-led, continues to reinvest in its product, is expanding in B2B and platform-based solutions, and maintains strong financial discipline. While most competitors either operate at smaller scale or with higher unit costs, Wise is strengthening its position in both the consumer and corporate segments.

Wise is an infrastructure asset in an active growth phase, with a vast runway ahead. We include Wise in our high-conviction ideas cohort with a position size of up to 10% of NAV. In our view, the current price presents a reasonable entry point.

Sources

[1] https://moneyweek.com/economy/people/603574/the-story-of-wise-a-multi-billion-fintech-started-by-accident?utm_source=chatgpt.com

[2]https://tracxn.com/d/companies/wise/__YAuKfycFmfMvs6MmH65xgzFBaakq0ec3oksdVFrUAWI/funding-and-investors?utm_source=chatgpt.com#funding-rounds

[3] https://wise.com/imaginary-v2/images/5b2bb84ff23eb690fda40fa9a92c27ed-HY_FY25_Sep-24_Presentation.pdf

[4] https://www.londonstockexchange.com/news-article/WISE/holding-s-in-company/16609867

[5] https://wise.com/imaginary-v2/images/b4e39297919e9749b16f13f504929e75-Wise_2024_Annual_Report_and_Acounts.pdf

[6] https://www.mckinsey.com/industries/financial-services/our-insights/banking-matters/how-banks-can-win-back-lower-value-cross-border-payments-business

[7] https://www.worldbank.org/en/news/press-release/2024/06/26/remittances-slowed-in-2023-expected-to-grow-faster-in-2024#:~:text=Sending%20remittances%20remains%20too%20costly,technological%20advancements%20in%20reducing%20the

[8] https://www.fxstreet.com/analysis/the-market-moving-data-this-week-comes-from-everywhere-other-than-the-us-202405201254#:~:text=%E2%80%9CThe%20euro%20and%20U,%E2%80%9D

[9] https://wise.com/imaginary-v2/images/915eb3b394df2a0159500f72b8034ff2-2023%20Remittances%20Report%20-%20FINAL.pdf#:~:text=networks%20who%20can%20operate%20with,Furthermore%2C%20compliance%20with

[10] https://wise.com/imaginary-v2/images/915eb3b394df2a0159500f72b8034ff2-2023%20Remittances%20Report%20-%20FINAL.pdf#:~:text=While%20there%20is%20evidence%20that,traditional%20banking%20associated%20with%20higher

[11]https://remittanceprices.worldbank.org/sites/default/files/rpw_main_report_and_annex_q224.pdf

[12] https://www.saveonsend.com/bank-money-transfer/?utm_source=chatgpt.com

[13] https://wise.com/imaginary-v2/images/a743105a05bf55701e3690fab53bc43d-WiseFY25AnalystPresentation.pdf

[14] https://d18rn0p25nwr6d.cloudfront.net/CIK-0001365135/0ec0aec2-5987-44ee-8629-d6e6e0ce56a1.pdf

[15] https://wise.com/imaginary-v2/images/7225a78f5d177b9bba2c8152e664ee7e-Wiseplc-FY2025.pdf

[16] https://www.saveonsend.com/transferwise-money-transfer/

[17] vimeo

[18] https://www.saveonsend.com/bank-money-transfer/?utm_source=chatgpt.com

[19] https://www.congress.gov/bill/119th-congress/house-bill/1/text

[20] https://www.airwallex.com/newsroom/airwallex-raises-usd300-million-at-a-usd6-2-billion-valuation-to-build-the-future-of-global-banking

[21] YouTube

[22] https://wise.com/gb/blog/transferwise-debit-card-launch?utm_source=chatgpt.com

[23] https://wise.com/imaginary-v2/FY23-Mar-23-Analyst-Presentation-(June-27-2023).pdf

[24] https://newsroom.wise.com/en-CAS/243185-standard-chartered-partners-with-wise-platform-to-transform-international-payments-experience?utm_source=chatgpt.com

[25] https://wise.com/gb/blog/wise-morgan-stanley?utm_source=chatgpt.com

[26] https://wise.com/gb/blog/raiffeisen-bank-international-and-wise-platform

[27] https://wise.com/imaginary-v2/images/7225a78f5d177b9bba2c8152e664ee7e-Wiseplc-FY2025.pdf

[28] https://www.bankingdive.com/news/coinbase-muscles-in-on-popular-remittance-corridor/618968/?utm_source=chatgpt.com

[29] https://www.reuters.com/business/crypto-exchange-kraken-debuts-peer-to-peer-payments-app-krak-2025-06-26/?utm_source=chatgpt.com

[30] https://www.reuters.com/article/business/blockchain-firm-ripple-to-end-partnership-with-moneygram-idUSKBN2B02IM/?utm_source=chatgpt.com

[31] https://www.saveonsend.com/bitcoin-blockchain-money-transfer/

[32] https://wise.com/gb/blog/unicredit-chooses-wise-platform

[33] Bloomberg

Great write up about Wise. I have also did a deep dive on WISE over a month ago and I have reached the same conclusion. If you would like to read it click here: https://therationalcapitalist.substack.com/p/why-the-market-underestimating-wise

Very informative report and I appreciate the attached model. Well done!